How to Close a Pvt Ltd Company or LLP: Process and Legal Requirements

Dissolving a Private Limited Company (Pvt Ltd) or a Limited Liability Partnership (LLP) in India requires adherence to legal frameworks outlined in the Companies Act, 2013, and the LLP Act, 2008. Businesses may seek closure due to financial struggles, inactivity, regulatory burdens, or strategic restructuring.

Depending on the circumstances, they can choose voluntary strike-off, liquidation, or tribunal-ordered winding up. The process typically includes passing a board or partners’ resolution, clearing outstanding liabilities, submitting necessary forms like STK-2 for Pvt Ltd and LLP Form 24 for LLPs, and securing approval from regulatory authorities.

Voluntary liquidation requires appointing a liquidator to manage asset distribution and creditor settlements. In cases of compulsory winding-up, the National Company Law Tribunal (NCLT) oversees proceedings, especially when legal disputes or creditor claims arise. Common challenges include regulatory delays, pending tax dues, and extensive documentation requirements. Ensuring proper compliance is essential to prevent future liabilities and legal consequences.

Expert legal assistance simplifies the process, ensuring accurate documentation, timely filings, and regulatory adherence. Vakilkaro provides professional guidance for seamless Pvt Ltd and LLP closures, handling legal complexities efficiently. Their expert team ensures smooth dissolution by assisting with paperwork, financial settlements, and compliance with government regulations. By choosing the right closure method and fulfilling legal obligations, businesses can dissolve operations efficiently without future risks.

Introduction

Closing or dissolving a Private Limited Company (Pvt Ltd) or a Limited Liability Partnership (LLP) in India is a structured legal process governed by the Companies Act, 2013 and the Limited Liability PartnershipAct, 2008, respectively. Whether due to financial difficulties, inactivity, or strategic decisions, businesses must follow the proper legal framework to ensure compliance and avoid future liabilities. This blog provides a step-by-step guide on the methods, legal requirements, and procedures for closing a Pvt Ltd or LLP in India.

Why Close or Dissolve a Pvt Ltd or LLP?

Companies or LLPs may opt for dissolution due to the following reasons:

- Financial Constraints: Inability to sustain business operations due to financial losses.

- Dormant Status: No business activities conducted for an extended period.

- Strategic Shift: Businesses merging with other entities or restructuring.

- Regulatory Compliance Burden: High maintenance costs of annual filings and regulatory compliance.

- Voluntary Decision: Owners may choose to close due to personal or strategic reasons.

Methods of Closing a Private Limited Company

1. Strike Off under Fast Track Exit Scheme (Voluntary Closure)

The Ministry of Corporate Affairs(MCA) allows inactive companies to be struck off under Section 248 of the Companies Act, 2013. This is a simple and less expensive method.

Eligibility for Strike-Off

- The company has not commenced operations since incorporation or has been inactive for the past two financial years.

- No pending litigation or liabilities exist.

- The company does not have active business transactions.

Procedure for Strike-Off

- Board Resolution: Pass a resolution to approve closure.

- Clear Liabilities: Settle outstanding dues, including taxes and employee payments.

- Affidavit & Indemnity Bond: Directors must submit affidavits declaring no liabilities.

- Filing of STK-2 Form: Apply for the MCA with the required documents.

- Approval from MCA: The Registrar of Companies (ROC) verifies and publishes the strike-off notice.

- Company Struck Off: After completion, the company is removed from the records.

2. Voluntary Liquidation (Members’ Voluntary Winding Up)

If a company wishes to close even while solvent, it can opt for voluntary liquidation under the Insolvency and Bankruptcy Code (IBC), 2016.

Procedure for Voluntary Liquidation

- Board Resolution: Directors pass a resolution for liquidation.

- Declaration of Solvency: Directors declare that the company has no pending debts.

- Appoint a Liquidator: A professional liquidator handles asset distribution and closure.

- Creditor Approval: 75% of shareholders and creditors must approve the decision.

- Final Submission: The liquidator submits reports and dissolves the company.

3. Compulsory Liquidation (Court-Ordered Winding Up)

If a company defaults on financial obligations, creditors, shareholders, or regulatory authorities can file for compulsory winding up.

Reasons for Compulsory Liquidation

- Continuous non-compliance with laws.

- Inability to pay creditors.

- Engaging in fraudulent activities.

- Government intervention due to regulatory violations.

Procedure for Compulsory Liquidation

- Filing a Petition: A creditor, shareholder, or regulatory authority files a winding-up petition.

- Court Hearing: The National Company Law Tribunal (NCLT) examines the petition.

- Appointment of Liquidator: The liquidator assesses and sells assets to repay creditors.

- Final Dissolution Order: NCLT approves dissolution and removes the company from records.

Methods of Closing an LLP

1. Voluntary Strike Off under LLP Form 24

The simplest method for inactive LLPs is to file for strike-off under Rule 37 of the LLP Rules, 2009.

Eligibility for Strike Off

- LLP must not have conducted business for one year or more.

- No pending creditors, liabilities, or disputes.

Procedure for Strike Off

- Partners’ Resolution: All partners must consent to closure.

- File LLP Form 24: Apply with required documents, including NOC from creditors.

- MCA Verification: The Registrar of Companies (ROC) verifies and publishes the dissolution notice.

- LLP Closure: MCA removes the LLP from its register.

2. Voluntary Winding Up

If an LLP decides to wind up operations while solvent, it can opt for voluntary liquidation.

Procedure for Voluntary Winding Up

- Pass a Resolution: Partners approve the dissolution.

- Appoint Liquidator: A licensed professional liquidator takes charge.

- Settle Dues: The liquidator repays all debts and distributes assets.

- MCA Filing: After asset settlement, submit dissolution documents to the MCA.

- Dissolution Approval: Upon verification, the LLP is officially closed.

3. Compulsory Winding Up (Tribunal Order)

A creditor, regulatory body, or partner may file a winding-up petition under Section 64 of the LLP Act, 2008, if the LLP:

- Cannot pay debts.

- Has engaged in fraudulent activities.

- Has violated statutory regulations.

Procedure for Compulsory Winding Up

- Petition Filing: The petitioner submits a case to NCLT.

- Tribunal Hearing: NCLT assesses financial and legal compliance.

- Appointment of Liquidator: The liquidator disposes of assets to clear liabilities.

- Final Closure Order: NCLT declares LLP dissolution.

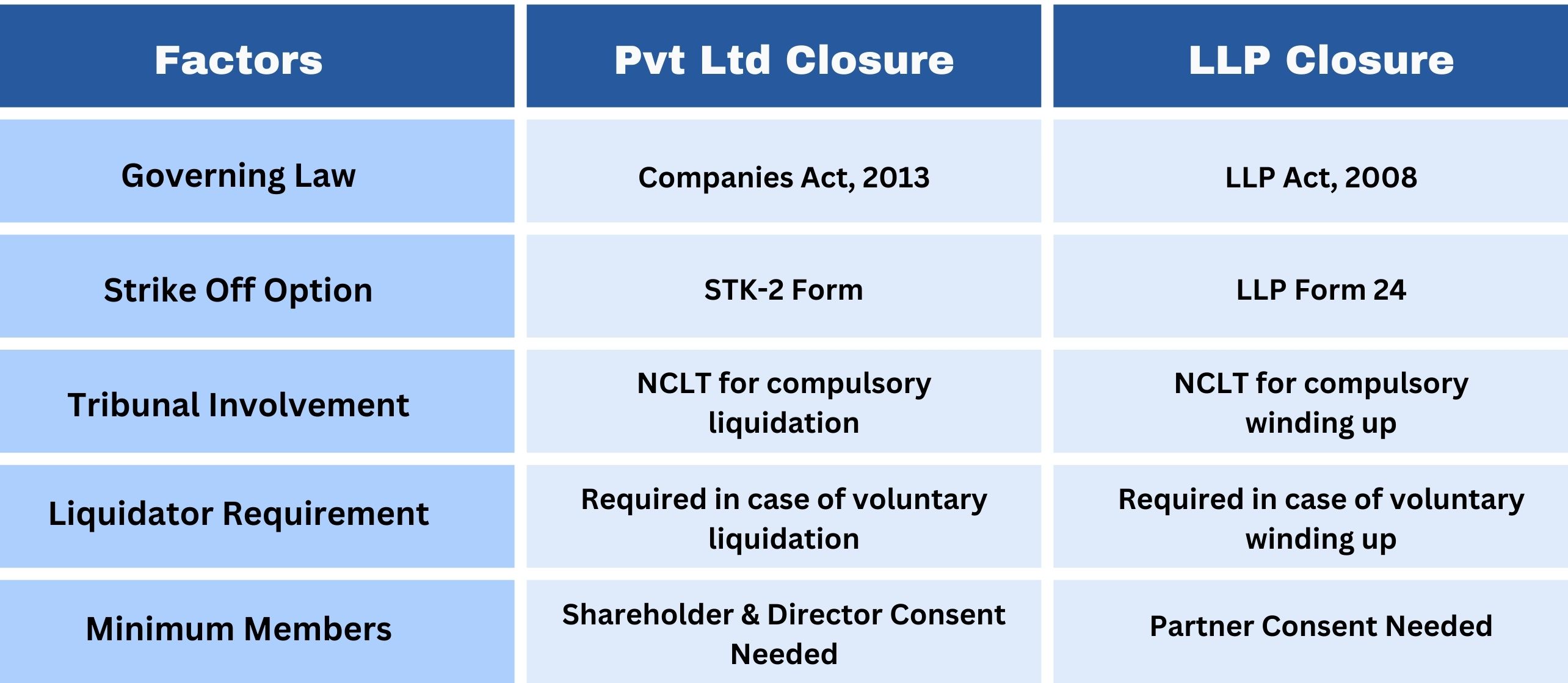

Key Differences Between Pvt Ltd and LLP Closure

Common Challenges in Closing a Pvt Ltd or LLP

- Regulatory Delays: Time-consuming verification by authorities.

- Outstanding Liabilities: Pending tax dues or unpaid creditors can block closure.

- Multiple Filings: Complex documentation and compliance requirements.

- Tribunal Hearings: For compulsory closure, legal representation is required.

Conclusion

Closing a Private Limited Company or an LLP requires a thorough understanding of legal procedures and regulatory compliance. While voluntary closure is straightforward for inactive businesses, compulsory winding-up cases require careful handling of creditors, legal documentation, and tribunal hearings.

Seeking professional legal and financial assistance can streamline the process and ensure hassle-free closure. Whether opting for strike-off, voluntary liquidation, or tribunal-directed closure, following the correct procedures helps in avoiding future liabilities and maintaining a clean legal standing.

Why Choose Vakilkaro for Closing or Dissolving a Pvt Ltd Company or LLP?

Closing a Private Limited Company (Pvt Ltd) or a Limited Liability Partnership (LLP) requires legal expertise, meticulous documentation, and adherence to regulatory compliance. Vakilkaro simplifies this complex process with expert legal guidance, ensuring a hassle-free dissolution while avoiding future liabilities.

Their professionals assist in selecting the appropriate closure method—strike-off, voluntary liquidation, or tribunal-directed winding up—based on the company’s financial and operational status. Vakilkaro handles everything from board resolutions, asset settlements, and creditor clearances to MCA and NCLT filings, minimizing delays and ensuring full compliance with legal norms. With their end-to-end support, businesses can achieve seamless closure while staying legally protected.

Why Choose Vakilkaro for Legal and Business Services?

Vakilkaro offers comprehensive legal and business solutions, ensuring seamless compliance, efficiency, and expert guidance across various domains. From NGO registration GST return filing and trademark registration to corporate governance, RBI licensing, and microfinance compliance, Vakilkaro provides end-to-end support tailored to business needs.

Their team of experienced professionals ensures accurate documentation, timely regulatory filings, and hassle-free legal processes, minimizing risks and liabilities. Whether it’s contract drafting, tax advisory, intellectual property protection, or business restructuring, Vakilkaro’s expertise guarantees smooth operations and compliance with legal norms. With client-focused service and affordable pricing, Vakilkaro is the ideal partner for businesses seeking reliable legal solutions.