How Microfinance Companies Raise Capital: Shares, Debentures, and Regulatory Limits

Microfinance companies play a vital role in financial inclusion by providing small loans and financial services to individuals and businesses that lack access to traditional banking. Entrepreneurs and investors often wonder whether a microfinance company can issue shares or debentures, as this determines how they can raise capital for expansion and sustainability. The answer depends on the legal structure of the microfinance company.

A Section 8 microfinance company registration registered as a not-for-profit entity under the Companies Act, 2013, is restricted from issuing shares or debentures. These companies are established for charitable purposes, including financial inclusion, and cannot raise funds through equity or debt securities. Instead, they rely on alternative funding sources such as donations, grants, and soft loans from government bodies, NGOs, and CSR initiatives of corporations. The inability to issue shares or debentures ensures that Section 8 companies maintain their non-profit status and do not distribute profits to shareholders.

On the other hand, an NBFC-MFI (Non-Banking Financial Company-Microfinance Institution) is a profit-oriented financial entity regulated by the Reserve Bank of India (RBI). Unlike Section 8 companies, NBFC-MFIs can issue shares and debentures under specific regulatory conditions. They can raise capital by issuing equity shares to investors, promoters, or financial institutions. Additionally, they can issue secured and unsecured debentures to institutional investors or through public offerings, subject to compliance with RBI and SEBI regulations.

Understanding these distinctions is crucial for entrepreneurs planning to enter the microfinance sector. While Section 8 microfinance companies operate on grants and donations, NBFC-MFIs have more flexibility in raising capital. Choosing the right legal structure ensures compliance with regulatory requirements while securing adequate funding for sustainable business growth.

Introduction

Microfinance companies are instrumental in promoting financial inclusion by offering small loans and essential financial services to individuals and businesses that do not have access to conventional banking systems. These institutions bridge the gap between the unbanked population and financial stability by providing credit to small entrepreneurs, self-employed individuals, and low-income groups. Their role is particularly significant in developing economies, where access to formal credit remains a challenge.

For entrepreneurs and investors interested in establishing or expanding microfinance businesses, one of the most critical questions is whether a microfinance company can issue shares or debentures. This inquiry is crucial because capital is the backbone of any financial institution, enabling it to sustain its operations, disburse more loans, and extend services to a larger population. Without sufficient funding, a microfinance company may struggle to meet the growing demand for credit and financial services.

The ability to raise capital through shares or debentures depends on the legal structure of the microfinance company In India, microfinance institutions typically operate under two primary models: Section 8 microfinance companies and Non-Banking Financial Company-Microfinance Institutions (NBFC-MFIs). Each structure has its own regulations regarding capital-raising mechanisms. While an NBFC-MFI may issue shares and debentures under certain conditions, a Section 8 microfinance company, being a not-for-profit entity, faces restrictions on such financial instruments.

Understanding the regulations surrounding capital-raising methods is essential for microfinance companies to expand their outreach, enhance their lending capabilities, and ensure long-term sustainability. This article explores the legal framework governing microfinance companies, the differences between Section 8 microfinance companies and NBFC-MFIs, and the options available for securing funding to support their mission of financial inclusion.

Understanding Microfinance Companies

Microfinance companies in India function under two primary legal structures: Section 8 microfinance companies and Non-Banking Financial Company-Microfinance Institutions (NBFC-MFIs). The legal framework governing these entities dictates their operational scope, capital-raising options, and compliance requirements. Understanding these structures is crucial for entrepreneurs and investors looking to establish a microfinance business and for those seeking funding avenues to scale their operations.

1. Section 8 Microfinance Companies

A Section 8 microfinance company is a non-profit entity registered under the Companies Act, 2013. These companies are formed with the primary objective of promoting charitable and social causes, including financial inclusion. Since they operate on a not-for-profit basis, their ability to raise capital is restricted. They are not allowed to issue shares or debentures because:

- They cannot distribute profits – Section 8 companies are designed to reinvest any earnings into their social mission rather than providing dividends to shareholders.

- Restricted fundraising methods – They primarily rely on donations, grants, government subsidies, and soft loans to finance their lending operations.

- No public investment opportunities – Unlike for-profit companies, Section 8 microfinance companies cannot invite public investment through stock market listings or private equity funding.

Despite these restrictions, Section 8 microfinance companies play a vital role in providing small loans to underserved communities, relying on alternative funding mechanisms to sustain and expand their services.

2. NBFC-Microfinance Institutions (NBFC-MFIs)

Unlike Section 8 companies, NBFC-MFIs are for-profit entities regulated by the Reserve Bank of India(RBI). They are established with the goal of providing financial services and microcredit to individuals and small businesses. Since NBFC-MFIs are profit-driven, they have more flexibility in raising capital, including:

- Issuance of equity shares – They can raise funds by selling equity shares to investors, venture capital firms, or private equity firms.

- Issuance of debentures – These companies can issue secured and unsecured debentures to raise debt capital, subject to RBI guidelines.

- Public and private investments – Larger NBFC-MFIs with significant capital may opt for listing on stock exchanges to attract public investment.

- Bank loans and foreign investments – They can secure funding through institutional loans and foreign direct investment (FDI), provided they meet regulatory conditions.

Since NBFC registration involves strict compliance with RBI regulations and the Companies Act, 2013, these institutions must maintain a minimum net owned fund (NOF) and obtain necessary approvals before issuing shares or debentures.

The Microfinance Company Registration Process

The microfinance company registration process in Hindi and English provides detailed guidelines on setting up a microfinance institution under these two structures. The process involves:

- Choosing the appropriate business structure (Section 8 Company or NBFC-MFI).

- Registering under the Companies Act, 2013 with the Ministry of Corporate Affairs (MCA).

- Obtaining RBI approval (for NBFC-MFIs) and ensuring compliance with regulatory capital requirements.

- Applying for tax exemptions (for Section 8 companies) and securing funding through permitted channels.

The choice between a Section 8 microfinance company and an NBFC-MFI depends on the organization’s profit motive, capital requirements, and compliance capacity. Entrepreneurs must carefully evaluate these factors before starting a microfinance business to ensure long-term sustainability and regulatory compliance.

Section 8 Microfinance Companies and Issuance of Shares or Debentures

A Section 8 microfinance company is a not-for-profit entity established under the Companies Act, 2013 to promote charitable activities, including financial inclusion for underserved communities. Unlike for-profit financial institutions, Section 8 microfinance companies do not operate with the primary goal of generating profits. Instead, they focus on providing low-cost financial services to individuals and small businesses that lack access to traditional banking.

However, raising capital for these companies is highly restricted, as they are not allowed to issue shares or debentures. This limitation exists because of their non-profit status and regulatory obligations. Let’s explore the key reasons why Section 8 microfinance companies cannot raise funds through equity or debt instruments.

1. Non-Profit Status

Section 8 microfinance companies are established with social welfare objectives rather than profit-making intentions. Since their mission is to support financial inclusion rather than generate investor returns, they are legally prohibited from:

- Distributing profits as dividends to shareholders.

- Raising capital through equity investments.

- Issuing public shares or private equity stakes.

This ensures that all funds received by a Section 8 microfinance company are directed toward its social objectives rather than benefiting investors.

2. Restrictions on Capital Raising

Unlike Non-Banking Financial Companies(NBFCs), which can issue shares and debentures to attract investment, Section 8 microfinance companies rely on alternative funding methods, such as:

- Grants from government bodies supporting financial inclusion initiatives.

- Donations from corporations under Corporate Social Responsibility (CSR) programs.

- Subsidies from international development organizations and NGOs.

Since these companies operate on philanthropic principles, they do not have the flexibility to secure funds from capital markets or private investors the way NBFCs do.

3. Prohibited from Public Investments

Section 8 microfinance companies are not permitted to invite public investment through shares or debentures. This restriction exists to maintain their non-profit status and prevent commercial interests from influencing their operations. Consequently, they cannot:

- Be listed on stock exchanges to raise capital.

- Offer debentures or bonds to institutional or retail investors.

- Seek funding from venture capitalists or private equity firms.

These regulations ensure that Section 8 microfinance companies remain focused on their mission of financial inclusion rather than commercial expansion.

Alternative Fundraising Methods for Section 8 Microfinance Companies

Despite these restrictions, Section 8 microfinance companies still have several ways to secure funding:

✅ Donations from CSR Initiatives – Large corporations often contribute to Section 8 companies under CSR (Corporate Social Responsibility) programs, supporting financial inclusion efforts.

✅ Grants from Financial Institutions and NGOs – Many banks, government agencies, and international organizations provide grants to Section 8 companies engaged in microfinance activities.

✅ Soft Loans from Banks and Government Schemes – Section 8 microfinance companies can borrow funds at subsidized rates from banks and government-sponsored financial programs.

While Section 8 microfinance companies play a vital role in providing financial services to marginalized communities, their fundraising capabilities are significantly limited by legal restrictions. They cannot issue shares or debentures due to their non-profit status, capital-raising restrictions, and prohibition from public investments. However, they can still secure funds through donations, grants, and soft loans to support their mission of financial inclusion. Entrepreneurs looking to start a microfinance company under Section 8 must carefully evaluate these funding options and ensure compliance with regulatory guidelines.

Can an NBFC Registration Issue Shares or Debentures?

NBFC-MFIs are profit-driven entities regulated by the Reserve Bank of India (RBI). Unlike Section 8 microfinance companies, an NBFC registration can issue shares or debentures under specific conditions:

- Equity Shares: An NBFC-MFI can raise funds by issuing equity shares to investors, promoters, and financial institutions.

- Debentures: These companies can issue secured and unsecured debentures to institutional investors and the public, subject to RBI regulations.

- Private Placement: Many NBFCs raise funds through private placement of shares and debentures to select investors.

- Public Issue: Larger NBFCs with substantial capital can list themselves on stock exchanges and issue shares to the public.

Regulatory Framework Governing NBFC-MFI Capital Raising

Before an NBFC-MFI can issue shares or debentures, it must comply with several regulations set by the RBI and the Companies Act, 2013:

- Minimum Net Owned Fund (NOF): An NBFC-MFI must maintain the prescribed NOF to qualify for issuing securities.

- Credit Rating Requirements: Issuing debentures often requires a credit rating from recognized agencies.

- SEBI and RBI Compliance: Any public issuance of shares or debentures must comply with Securities and Exchange Board of India (SEBI) and RBI guidelines.

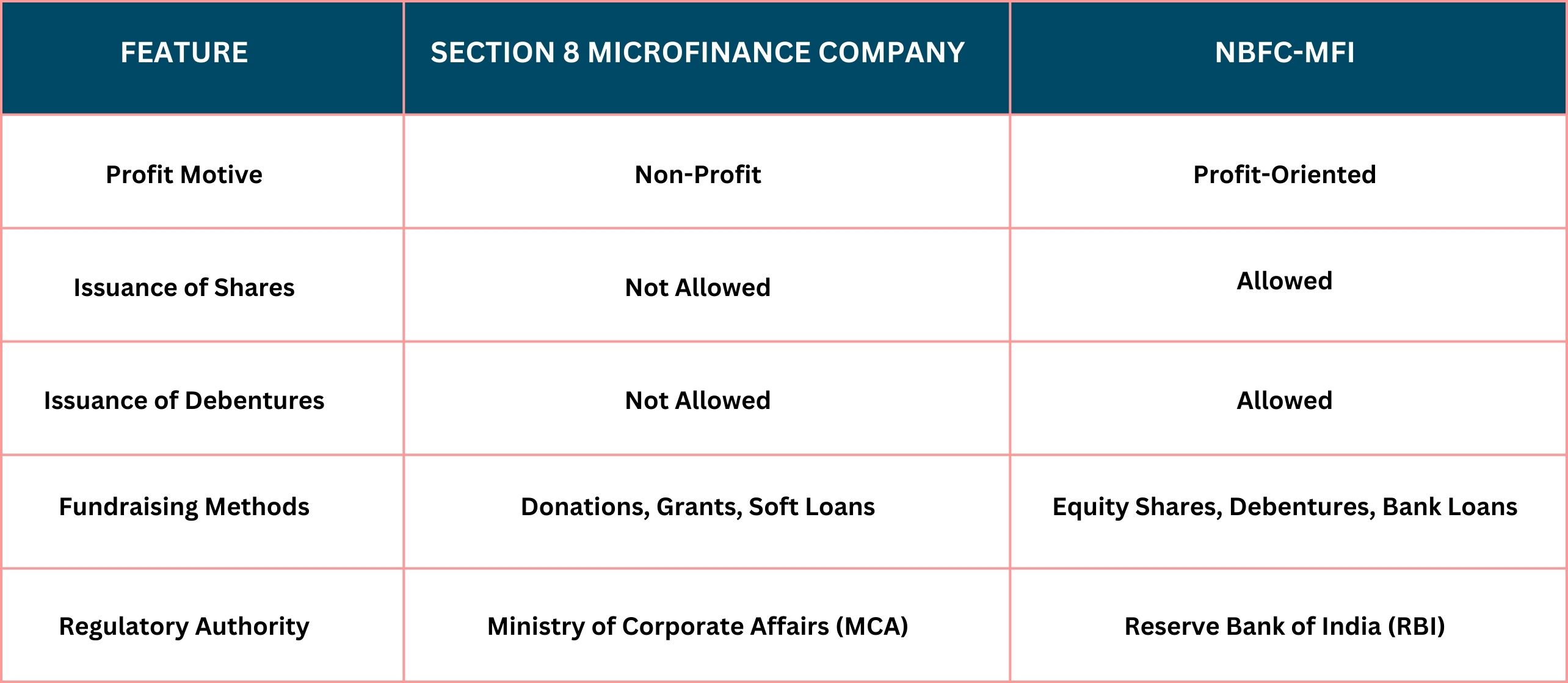

Key Differences Between Section 8 Microfinance and NBFC-MFI in Capital Raising

Why Fundraising is Important for Microfinance Companies?

Microfinance companies require adequate capital to expand their reach and serve more underserved communities. Capital enables them to:

- Increase Loan Disbursement: More funds allow them to issue more microloans.

- Maintain Liquidity: A stable capital base ensures smooth business operations.

- Expand Geographic Reach: More funding helps scale operations to new regions.

- Ensure Compliance with RBI Norms: NBFC-MFIs must meet financial requirements to maintain their licenses.

Alternative Funding Options for Microfinance Companies

Besides issuing shares or debentures, microfinance companies can explore:

- Bank Loans: Many banks offer loans to registered microfinance companies.

- Foreign Direct Investment (FDI): NBFC-MFIs can attract foreign investment under RBI guidelines.

- Government Schemes: Various government programs provide financial support to microfinance institutions.

- Impact Investors & Venture Capitalists: These investors provide funds in exchange for equity in profit-oriented microfinance companies.

Conclusion

The ability of a microfinance company to issue shares or debentures depends on its legal structure. A Section 8 microfinance company cannot issue shares or debentures due to its non-profit status, whereas an NBFC-MFI can issue both, subject to regulatory approvals. Understanding the microfinance company registration process in Hindi or English is crucial for entrepreneurs planning to start a microfinance business. If you are considering launching a microfinance company, choosing the right structure is essential to determine your fundraising capabilities. Always consult legal and financial experts to ensure compliance with RBI and SEBI regulations while raising capital.

Why Choose Vakilkaro for Legal and Business Services?

Vakilkaro is a trusted name in legal and business consulting, offering comprehensive solutions for entrepreneurs, startups, and established businesses. With a team of experienced legal professionals, financial experts, and business consultants, Vakilkaro ensures seamless assistance in various legal and compliance matters. Here’s why you should choose Vakilkaro for your legal, financial, and corporate needs:

1. Expertise Across Multiple Services

Vakilkaro specializes in a wide range of legal and business services, including:

✅ Company Registration – Private Limited, LLP, One-Person Company, Section 8 Company, and more.

✅ GST & Tax Compliance – GST registration, filing, and advisory services.

✅ Trademark & Intellectual Property – Trademark registration, copyright, and patent protection.

✅ Legal Documentation – Drafting contracts, agreements, and compliance documents.

✅ Microfinance & NBFC Registration – Assistance in setting up microfinance institutions and NBFCs.

✅ RBI & Financial Licensing – RBI approvals for financial businesses, including Section 8 microfinance.

2. Seamless & Hassle-Free Process

Vakilkaro simplifies complex legal procedures by offering step-by-step guidance. Whether it’s business registration, trademark filing, or tax compliance, their team handles all documentation, filings, and approvals, ensuring a smooth experience.

3. Affordable & Transparent Pricing

Vakilkaro offers cost-effective services with transparent pricing. There are no hidden charges, and clients receive detailed cost breakdowns before proceeding.

4. Personalized Support & Consultation

Every business is unique, and Vakilkaro provides customized legal and financial solutions tailored to your specific requirements. Their dedicated support team ensures prompt assistance at every stage.

5. Fast Processing & Timely Execution

With industry expertise and a strong legal network, Vakilkaro ensures quick processing of applications and approvals. Whether it’s company registration GST filing or compliance, their team prioritizes efficiency and accuracy.

6. Trusted by Thousands of Businesses

Vakilkaro has successfully assisted thousands of businesses across India in legal, tax, and financial matters, earning a reputation for reliability and excellence.

Vakilkaro is your one-stop solution for all legal, tax, and business compliance needs. Their expertise, transparency, and customer-centric approach make them the ideal partner for entrepreneurs, startups, and businesses looking for reliable legal assistance. Whether you need company registration, GST compliance, trademark protection, or financial licensing, Vakilkaro ensures hassle-free services with expert guidance.