Understanding the Difference Between NBFC-MFI and Section 8 Microfinance Company Registration

Microfinance plays a pivotal role in expanding financial access to underserved individuals and small businesses. In India, microfinance institutions operate under two primary legal structures: NBFC-MFIs ( Non-Banking Financial Companies– Microfinance Institutions) and Section 8 Microfinance Company registration While both models aim to promote financial inclusion, they differ significantly in terms of registration process, regulatory requirements, and operational framework.

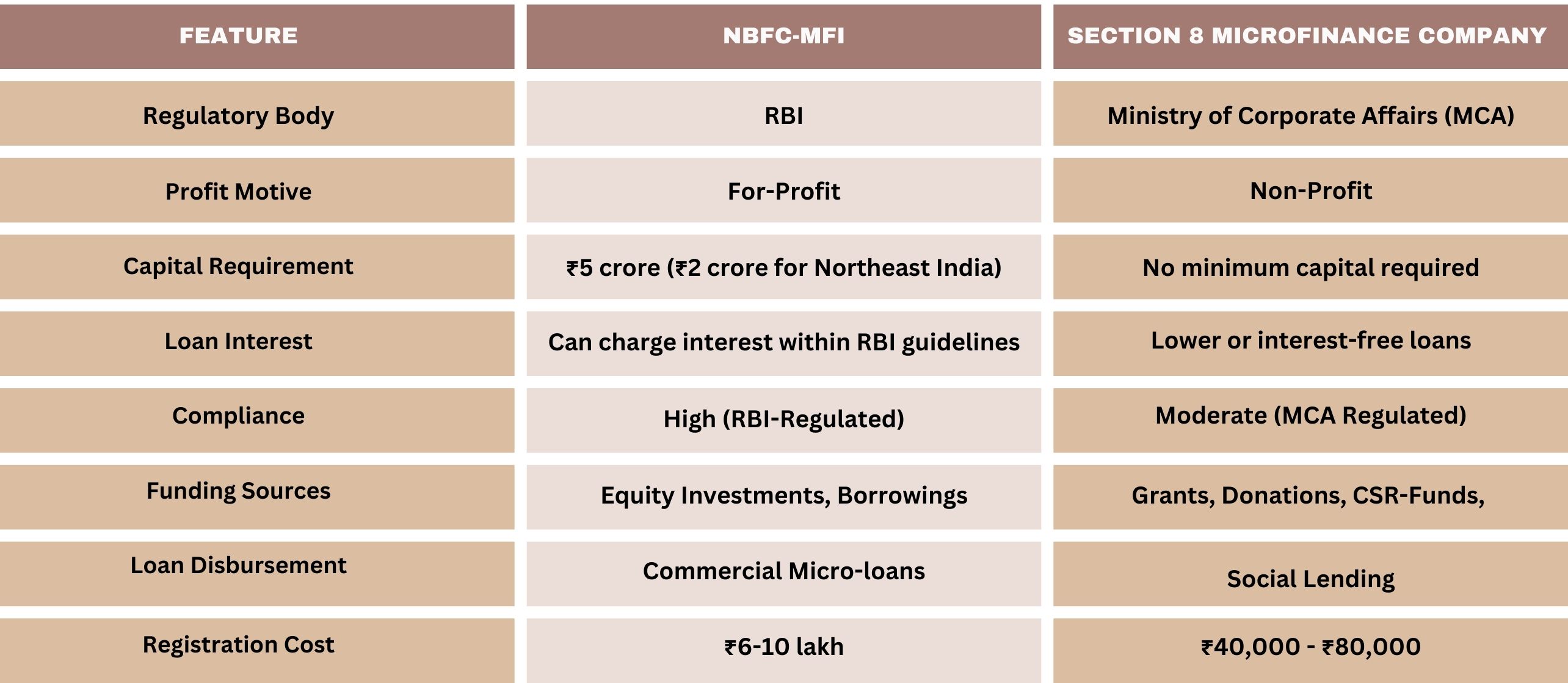

The micro finance company registration process varies depending on the chosen structure. An NBFC-MFI requires incorporation as a Private or Public Limited Company, followed by an application for RBI registration. Additionally, these institutions must maintain a minimum net owned fund (NOF) of ₹5 crore (₹2 crore for Northeastern states). The process involves submitting a detailed business plan, financial projections, and governance structure before obtaining the RBI license. On the other hand, Section 8 Microfinance Companies function asnon-profits under the Ministry of Corporate Affairs(MCA) and do not require RBI approval. Instead, they need to obtain a Section 8 license and register with the Registrar of Companies (ROC).

The micro finance company registration fee is significantly higher for NBFC-MFIs, ranging between ₹6-10 lakh, including RBI application fees, legal consultation, and compliance costs. In contrast, Section 8 microfinance company registration fees are relatively lower, typically between ₹40,000-₹80,000, covering incorporation, licensing, and legal fees.

Choosing between these models depends on your objectives. NBFC-MFIs are ideal for those seeking a for-profit microfinance business with scalability, while Section 8 companies suit organizations focused on social lending with lower capital requirements. Understanding these differences will help entrepreneurs select the appropriate structure based on their financial goals and regulatory compliance capabilities.

Introduction

Microfinance plays a crucial role in financial inclusion by providing credit and financial services to low-income individuals and small businesses. In India, two main legal structures govern microfinance institutions: NBFC-MFIs (Non-Banking Financial Company – Microfinance Institutions) and Section 8 Microfinance Companies. Both models operate under different regulatory frameworks, have distinct compliance requirements, and serve unique financial needs.

This blog explores the key differences between an NBFC-MFI and a Section 8 Microfinance Company, covering aspects such as their registration process, fees, and operational structure. If you are considering starting a microfinance company, understanding these differences will help you choose the right business model.

What is an NBFC-MFI?

An NBFC-MFI (Non-Banking Financial Company – Microfinance Institution) is a type of Non-Banking Financial Company (NBFC) that provides financial services to economically weaker sections. These institutions are regulated by the Reserve Bank of India(RBI) and primarily focus on providing micro-loans to individuals who lack access to traditional banking.

- Key Features of NBFC-MFIs:

Regulated by RBI: Strict compliance with RBI guidelines is required.

Loan Limits: Minimum 85% of total assets must be in the form of micro-loans.

Interest Rate Cap: RBI mandates a pricing cap to prevent excessive interest charges.

Credit Limit: Borrowers can avail of a maximum loan amount based on income criteria.

Mandatory Registration: Registration with RBI is compulsory.

- NBFC-MFI Registration Process:

To start an NBFC-MFI, one must follow these steps:

Incorporate a Company: Register a Private Limited CompanyorPublic Limited Company under the Companies Act, 2013.

Minimum Capital Requirement: Maintain a minimum net owned fund (NOF) of ₹5 crore (₹2 crore for Northeastern states).

Apply for RBI Registration:

- Submit an application online via the RBI portal.

- Provide a business plan, financial projections, and governance structure.

Obtain RBI License: Once approved, RBI grants the Certificate of Registration (CoR).

Commence Operations: After registration, the company can start lending under RBI guidelines.

- NBFC-MFI Registration Fees:

The overall registration cost includes:

Company incorporation: ₹15,000 – ₹25,000

RBI application fees: ₹3,00,000 (approx.)

Legal & Consultation Fees: ₹1,00,000 – ₹3,00,000

Compliance and documentation costs: Varies based on complexity

Total estimated cost: ₹6-10 lakh (approx.)

What is a Section 8 Microfinance Company?

A Section 8 Microfinance Company is a non-profit organization registered under Section 8 ofthe Companies Act, 2013 These companies aim to promote financial inclusion by providing interest-free or low-cost loans to underprivileged sections of society.

- Key Features of Section 8 Microfinance Companies:

Non-Profit Organization: Cannot distribute profits as dividends.

No RBI Approval Needed: Unlike NBFC-MFIs, Section 8 companies do not require an RBI license.

Lower Compliance Burden: No mandatory capital requirement.

Funding Sources: Can receive grants, donations, or CSR funds.

Loan Structure: Offers small-ticket loans at lower interest rates.

- Section 8 Microfinance Company Registration Process:

To register a Section 8 Microfinance Company, follow these steps:

Incorporate the Company:

- Register with the Ministry of Corporate Affairs (MCA) as a Section 8 Company.

- Provide MOA (Memorandum of Association) and AOA (Articles of Association).

Apply for License:

- Submit Form INC-12 along with the necessary documents.

- Obtain a Central Government license under Section 8 of the Companies Act.

Register with ROC (Registrar of Companies): Once the license is approved, file necessary incorporation documents.

Commence Operations: After incorporation, the company can start lending.

Section 8 Microfinance Company Registration Fees:

- Company incorporation: ₹10,000 – ₹15,000

- License fees: ₹5,000 (approx.)

- Legal & Consultation Fees: ₹25,000 – ₹50,000

Total estimated cost: ₹40,000 – ₹80,000 (approx.)

Key Differences Between an NBFC-MFI and a Section 8 Microfinance Company

Which Model Should You Choose?

Choose NBFC-MFI if:

- You want to run a for-profit microfinance business.

- You have ₹5 crore+ capital and can meet RBI compliance.

- You plan to charge interest and scale commercially.

Choose Section 8 Microfinance Company if:

- You aim to provide social impact lending.

- You do not have the required capital for NBFC-MFI.

- You plan to receive grants and donations.

Conclusion

Both NBFC-MFIs and Section 8 Microfinance Companies contribute significantly to financial inclusion in India. However, they differ in their business structure, compliance requirements, funding sources, and operational framework. If you are looking to start a microfinance company, understanding these distinctions will help you make an informed decision.

While NBFC-MFIs require higher capital investment and stringent compliance, they offer greater commercial viability. On the other hand, Section 8 Microfinance Companies provide a cost-effective, socially-driven alternative for financial inclusion.

For expert assistance in microfinance company registration, compliance, and licensing, you can consult legal and financial experts to ensure a smooth registration process.

Why Choose Vakilkaro for Microfinance Company Registration and Related Services?

Vakilkaro is a trusted legal and financial consulting firm specializing in microfinance company registration, compliance, and regulatory approvals. Whether you are setting up an NBFC-MFI or a Section 8 Microfinance Company, Vakilkaro provides expert guidance to streamline the entire process.

Expertise in NBFC-MFI and Section 8 Registration

Vakilkaro has a team of professionals with in-depth knowledge of RBI and MCA regulations, ensuring a hassle-free micro finance company registration process. From company incorporation to obtaining RBI or MCA approvals, they assist at every step.

Cost-Effective and Transparent Pricing

Vakilkaro offers affordable and transparent pricing for micro finance company registration fees. The estimated cost for NBFC-MFI registration is ₹6-10 lakh, while Section 8 microfinance company registration fees range from ₹40,000-₹80,000. Their cost-effective services help entrepreneurs and NGOs set up their businesses without unnecessary expenses.

End-to-End Legal and Compliance Support

Beyond registration, Vakilkaro ensures your microfinance business remains compliant with RBI, MCA, and financial regulations. They provide assistance with RBI licensing, tax complianceGST filing and financial audits to ensure smooth operations.

One-Stop Solution for Business Needs

In addition to microfinance registration, Vakilkaro offers company incorporationtrademark registration accounting, tax advisory, and loan facilitation. Their comprehensive services make them a reliable partner for startups, NGOs, and financial institutions.

By choosing Vakilkaro, you get personalized assistance, expert legal guidance, and cost-effective solutions, ensuring your microfinance business is set up and managed efficiently.