Do You Need RBI Approval to Start a Microfinance Company?

Microfinance companies play a vital role in offering financial services to individuals and small businesses that lack access to traditional banking facilities. If you are considering establishing a microfinance company in India, one of the key concerns is whether approval from the Reserve Bank of India (RBI) is required. The answer depends on the type of microfinance company you choose to register.

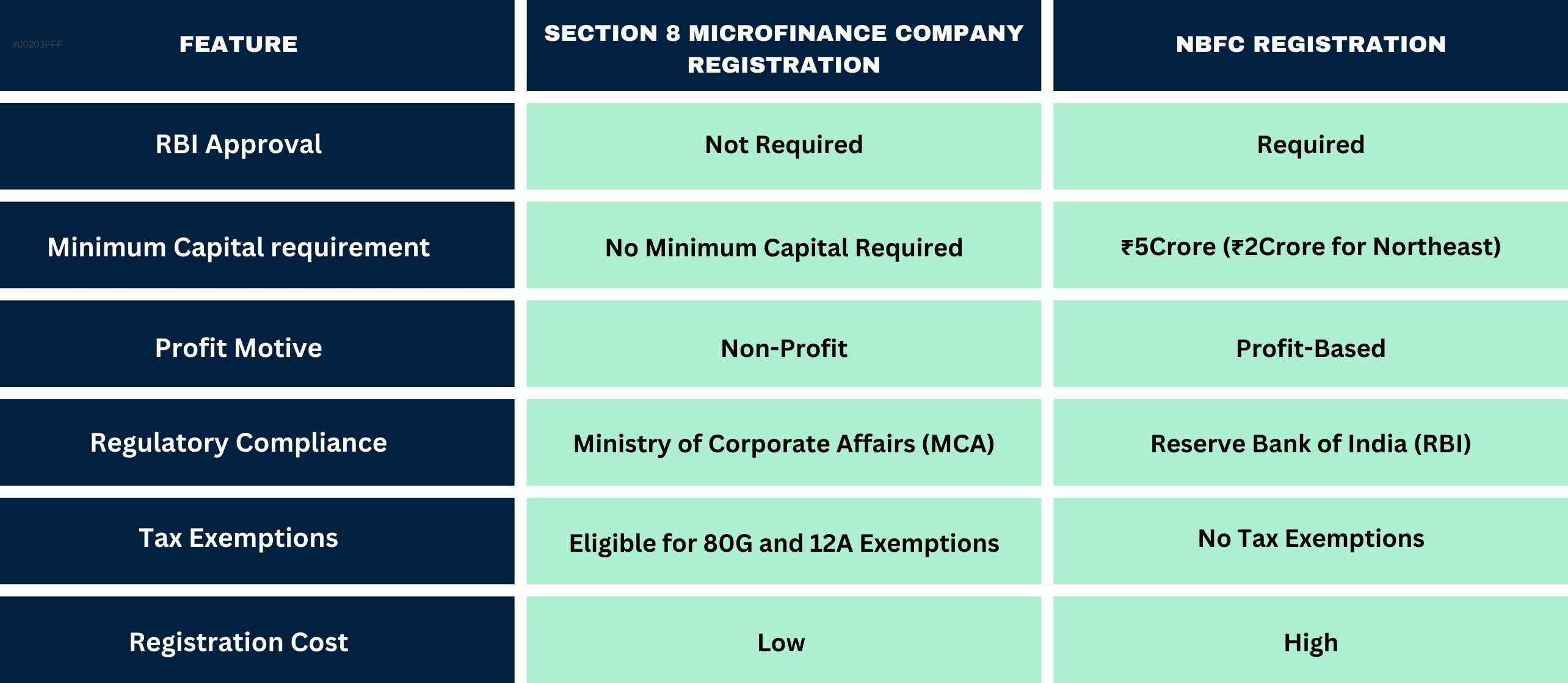

There are two primary types of microfinance companies in India: NBFC Microfinance Company and Section 8 Microfinance Companies. An NBFC registrationoperates under RBI regulations and requires approval before starting its operations. These companies must maintain strict compliance, including a minimum capital requirement of ₹5 crore (₹2 crore for the northeastern region). Due to the regulatory oversight, NBFC microfinance companies have higher operational and compliance costs but enjoy the benefit of being recognized as formal financial institutions.

On the other hand, a Section 8 Microfinance Company registrationis a non-profit organization registered under the Companies Act, 2013. It focuses on financial inclusion and social upliftment without a profit motive. Unlike NBFCs, Section 8 microfinance companies do not require RBI approval. Instead, they are regulated by the Ministry of Corporate Affairs (MCA), making the registration process simpler and more affordable. With no minimum capital requirement, lower compliance costs, and eligibility for tax exemptions under Section 12A and 80G, Section 8 microfinance companies are a preferred choice for NGOs and social enterprises.

Choosing the right structure depends on your business goals. If you seek to operate a for-profit microfinance company, an NBFC registration is required. However, if your objective is social impact, a Section 8 microfinance company is the more cost-effective and regulatory-friendly option.

Introduction

Microfinance companies serve as a crucial pillar in the financial ecosystem by extending financial services to individuals and small businesses that lack access to conventional banking facilities. These institutions bridge the gap for economically weaker sections by providing small loans, credit, and financial assistance to promote entrepreneurship and financial independence. If you are considering establishing a microfinance company in India, a key question is whether approval from the Reserve Bank of India (RBI) is mandatory.

The requirement for RBI approval depends on the type of microfinance company you intend to set up. There are two primary categories: NBFC Microfinance Companies and Section 8 Microfinance Companies. NBFC Microfinance Companies function under strict RBI regulations and require prior approval before commencing operations, ensuring compliance with financial norms and maintaining transparency in lending activities. These companies are structured to operate on a for-profit basis, necessitating a minimum net-owned fund of ₹5 crore (₹2 crore for northeastern states). In contrast, Section 8 Microfinance Companies, which are incorporated as non-profit entities under the Companies Act, 2013, do not require RBI approval. Instead, they are regulated by the Ministry of Corporate Affairs (MCA) and operate with a primary focus on financial inclusion and social upliftment. These companies have lower compliance costs, no minimum capital requirements, and can avail tax exemptions under Section 12A and 80G of the Income Tax Act. The choice between these two structures depends on the business objectives—whether one aims for a profit-driven microfinance model under RBI regulations or a non-profit financial inclusion initiative with fewer regulatory requirements. Understanding the registration process, fees, and compliance requirements for both types is crucial to making an informed decision.

Types of Microfinance Companies in India

1. NBFC Microfinance Company

Non-Banking Financial Company (NBFC) Microfinance Companies are financial institutions that provide small loans to low-income individuals. These companies operate under strict RBI guidelines and require prior approval from the Reserve Bank of India (RBI) before they can commence operations. NBFC registration involves compliance with several regulatory requirements, including a minimum net owned fund of ₹5 crore (₹2 crore for the northeastern region).

2. Section 8 Microfinance Company

A Section 8 microfinance company is a non-profit entity registered under the Companies Act, 2013 It aims to provide financial assistance without a profit motive and focuses on economic upliftment. Unlike an NBFC Microfinance Company, a Section 8 microfinance company does not require RBI approval. Instead, it must comply with the regulations of the Ministry of Corporate Affairs (MCA). This makes it a cost-effective and simpler option for entrepreneurs looking to enter the microfinance sector without RBI compliance.

Micro Finance Company Registration: Requirements & Process

The micro finance company registration process differs based on whether you are setting up an NBFC or a Section 8 microfinance company.

NBFC registration Registration Process:

- Company Incorporation: Register your business as a Private or Public Limited Company with MCA.

- Minimum Capital Requirement: Ensure you have a net owned fund of at least ₹5 crore.

- Apply for RBI Approval: Submit an application to the RBI along with all necessary documents.

- Obtain Certificate of Registration: Once RBI grants approval, your company can commence operations.

Since NBFCs are regulated by RBI, compliance requirements such as audits, reporting, and financial disclosures must be followed.

Section 8 Microfinance Company Registration Process

For those who prefer a simpler and cost-effective way to start a microfinance company, Section 8 microfinance company registration is the best option. Here’s how you can register one:

- Obtain DSC and DIN: The Directors must obtain a Digital Signature Certificate (DSC) and Director Identification Number (DIN).

- Name Reservation: Reserve the company name through the RUN (Reserve Unique Name) form on the MCA portal.

- Draft MOA and AOA: Draft the Memorandum of Association (MOA) and Articles of Association(AOA) defining the company’s objectives.

- Apply for Section 8 License: File an application with the Registrar of Companies (RoC) for approval.

- Incorporation Filing: Submit the SPICe+ form along with other required documents for company incorporation.

- Obtain PAN, TAN, and Bank Account: Once the company is registered, apply for PAN, TAN, and open a bank account to start operations.

Section 8 Microfinance Company Registration Fees

One of the biggest advantages of choosing a Section 8 microfinance company is the low cost of registration. Unlike an NBFC, which requires a high capital investment, a Section 8 company does not have any minimum capital requirement The typical fees involved in the Section 8 microfinance company registration process include:

- Government Fees: Approx. ₹3,000 to ₹5,000 depending on the state.

- Professional Fees: Varies based on the service provider assisting with registration.

- MOA and AOA Drafting: ₹5,000 to ₹10,000 depending on legal fees.

- DSC and DIN Costs: ₹1,000 to ₹2,500 per director.

Overall, Section 8 microfinance company registration fees are significantly lower than NBFC registration costs, making it an attractive option for those looking to enter the microfinance sector with minimal investment.

Comparison: Section 8 Microfinance Company Registration vs. NBFC Registration

Why Choose Section 8 Microfinance Company Registration Over NBFC Registration?

One of the biggest advantages of setting up a Section 8 Microfinance Company is that it does not require RBI approval, unlike an NBFC registration. This exemption significantly reduces the time, cost, and complexity involved in the registration process. Since obtaining an NBFC license from the Reserve Bank of India (RBI) requires meeting stringent financial and operational guidelines, choosing a Section 8 Microfinance Company saves entrepreneurs from the hassle of undergoing a lengthy approval process and ensures a quicker start to operations.

Another key benefit is the lower registration cost. While NBFC registration requires a minimum net owned fund of ₹5 crore (₹2 crore for the northeastern states), a Section 8 Microfinance Company has no such mandatory capital requirement. Entrepreneurs can set up a Section 8 company with minimal investment, making it a cost-effective option for those looking to provide financial services to underserved communities without heavy financial burdens.

Additionally, Section 8 Microfinance Companies enjoy tax benefits under Section 12A and 80G of the Income Tax Act, 1961. Once registered under these sections, the company can claim exemptions on its income, and donors contributing to the organization can also avail tax deductions. This helps non-profit microfinance companies attract funding and grants, ultimately supporting their mission of financial inclusion and economic development.

Moreover, Section 8 Microfinance Companies benefit from ease of operations due to their simpler regulatory requirements compared to NBFCs. Since these entities are regulated by the Ministry of Corporate Affairs(MCA) rather than RBI, they have fewer compliance obligations, such as periodic financial reporting, maintaining high capital reserves, and stringent auditing requirements. This makes managing and running a Section 8 Microfinance Company more straightforward, allowing it to focus on its core mission of providing affordable financial assistance to those in need.

Final Thoughts: Which One Should You Choose?

If your goal is to operate a microfinance company for profit, then registering as an NBFC registration is the right choice. However, be prepared for the extensive RBI approval process and higher capital requirements.

If you are focused on financial inclusion without a profit motive, then Section 8 microfinance company registration is the better option. It is affordable, does not require RBI approval, and offers tax exemptions, making it ideal for NGOs, non-profits, and social enterprises looking to provide financial assistance to the underserved.

Starting a microfinance company is a significant step toward financial inclusion in India. By understanding the micro finance company registration process and weighing the pros and cons of NBFC vs. Section 8 microfinance company, you can make an informed decision that aligns with your goals and resources.

Why Choose Vakilkaro for Legal and Financial Services?

Vakilkaro is a trusted platform that offers comprehensive legal, financial, and compliance services tailored to businesses, startups, and individuals. Whether you need assistance with microfinance company registration, NBFC registration, GST return filing company incorporation trademark registration tax advisory, or legal documentation, Vakilkaro provides expert guidance to streamline the entire process.

With a team of experienced professionals, Vakilkaro ensures accurate, hassle-free, and time-efficient solutions while keeping you compliant with regulatory requirements. Their personalized consultation, affordable pricing, and end-to-end support make them a preferred choice for entrepreneurs looking to navigate complex legal and financial frameworks effortlessly.