Essential Cost Components of Farmer Producer Company Registration in India (2025)

This comprehensive guide on Farmer Producer Company Registration provides a detailed overview of the fee structures, compliance requirements, and procedural documentation necessary for applicants across India. In recent years, following significant amendments to the Companies Act and updates in government fee structures nationwide, registering a Farmer Producer Company has become a well-defined process that emphasizes transparency and standardized cost structures.

Designed for a business-savvy audience, our guide includes the latest insights on Farmer Producer Company Registration fees calculations. Readers will gain a clear understanding of how to navigate compliance requirements and leverage practical examples, case studies, and updated pan-India fee structures. Special emphasis has been placed on major farming regions, providing users with valuable insights into regional variations in charges.

This guide on Farmer Producer Company Registration is indispensable for stakeholders looking to streamline their registration process and complete the necessary paperwork accurately. Our expert analysis is based on recent amendments under the Companies Act and reflects the current governmental fee structures and charges across the country.

Registration Process

The process of Farmer Producer Company Registration involves several clearly defined steps that ensure transparency and compliance with current regulations. This section outlines each phase of the registration process from initial application to final approval.

Step 1: Initial Consultation and Documentation

The first step in Farmer Producer Company Registration is collecting the requisite documentation. Applicants must prepare:

- Identity proofs of all promoters and stakeholders.

- Detailed business plans and cooperative schemes.

- Proof of land ownership or tenancy for the farming lands.

- Financial documents showing the source of initial capital.

It is essential to adhere to the latest compliance guidelines as set out by the Companies Act amendments and current government mandates on Farmer Producer Company Registration.

Step 2: Filing the Application

Next, applicants file the formal application for Farmer Producer Company Registration along with the necessary documents. Applications are usually submitted online via the Ministry of Corporate Affairs (MCA) portal along with required digital signatures and document scans.

In this phase, ensuring correct documentation as per Farmer Producer Company Registration guidelines is critical to avoid delays.

Step 3: Fee Payment and Verification

Once the application is prepared, applicants must pay the associated fees. The fee structure for Farmer Producer Company Registration follows the pan-India fee schedule established by the government, with fees differing slightly based on the region. This payment is verified by government officials to ensure accuracy and adherence to updated fee guidelines.

Step 4: Review, Inspection and Approval

Post verification, regulatory authorities conduct an inspection and review to validate the business profile and compliance conditions. Upon successful inspection, the Farmer Producer Company Registration is approved, and the company is duly incorporated under the Companies Act guidelines.

Each stage in the Farmer Producer Company Registration process is tracked digitally to maintain accountability and ensure timely updates for all stakeholders.

Step 5: Post Registration Compliance

After the registration is approved, companies are required to maintain continuous compliance. This involves:

- Filing periodic returns with the MCA.

- Maintaining records as per the Companies Act amendments.

- Regular audits and updates on operational status.

Adherence to these post-registration compliance measures assures that Farmer Producer Company Registration remains valid and transparent.

Fee Breakdown and Calculation

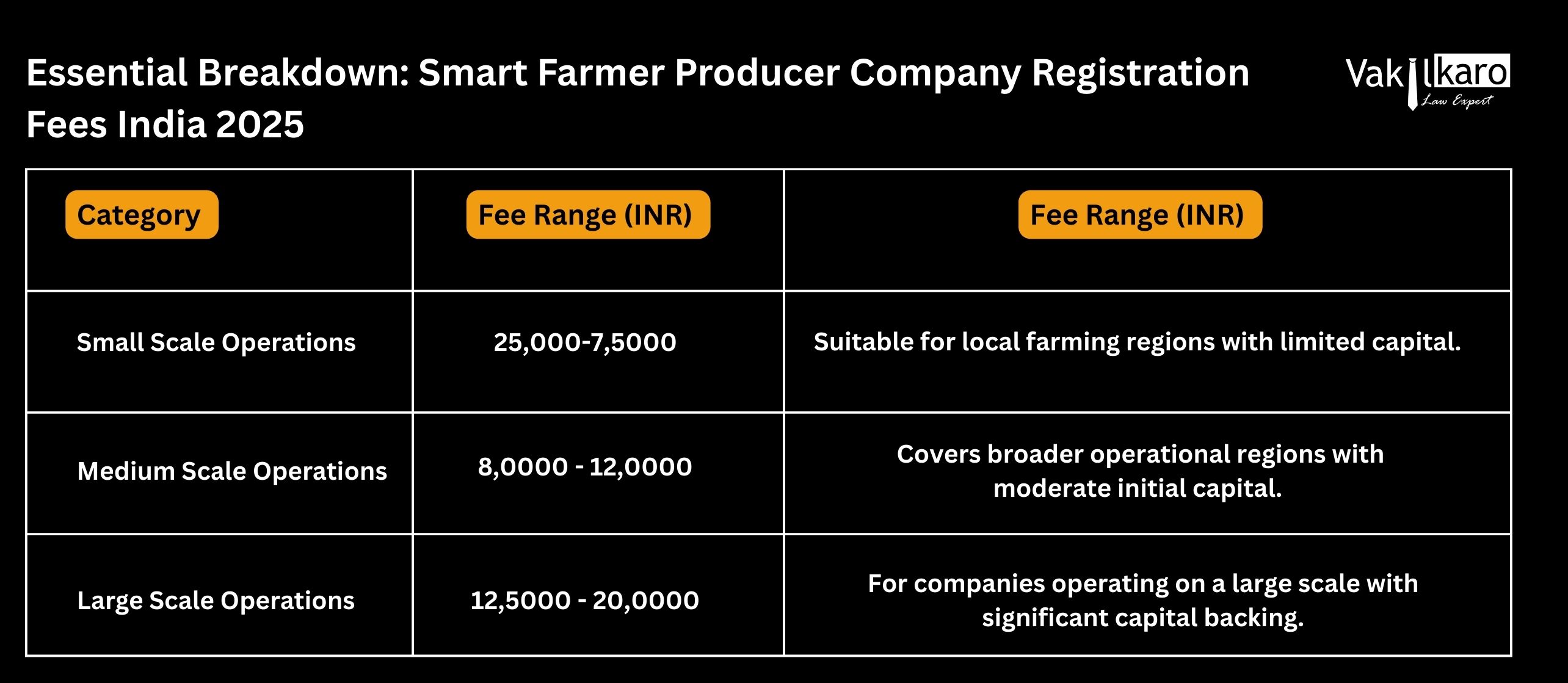

The fee structure for Farmer Producer Company Registration has evolved, reflecting the latest changes in government policies and amendments under the Companies Act. Understanding this fee breakdown is crucial for prospective applicants.

Basic Fee Structure

The basic fees are set by the Ministry of Corporate Affairs and vary by the amount of authorized capital and the intended business scale. The current fee schedule is as follows:

These fees applicable for Farmer Producer Company Registration are reflective of not only the administrative services but also the rigorous compliance checks mandated by the latest Companies Act amendments.

Additional Charges

In addition to the basic fee structure, applicants may incur additional costs for:

- Professional consultation and legal advisory related to Farmer Producer Company Registration.

- Notary and attestation fees required during the submission of documents.

- Digital signature certificates and other statutory certifications.

These additional expenses vary slightly regionally, and it is essential to incorporate these costs while planning for Farmer Producer Company Registration to avoid any unanticipated expenditure.

Pan-India Fee Structure with Regional Variations

The fee structure for Farmer Producer Company Registration across India is standardized. However, special emphasis is placed on major farming regions such as Punjab, Haryana, Maharashtra, and Uttar Pradesh, where:

- Punjab & Haryana: The fees marginally increase by 5% to account for higher transaction volumes.

- Maharashtra: Additional charges may apply for urban-based operations relative to rural outreach.

- Uttar Pradesh: There is a nominal increment reflecting the high demand for Farmer Producer Company Registration.

These regional adjustments in the Farmer Producer Company Registration fee structure ensure that all costs are adjusted to market needs while staying compliant with national standards.

Practical Fee Calculation Example

To illustrate the Farmer Producer Company Registration fee calculation, consider a medium scale operation with an initial application base fee of INR 10,000. The applicant also requires additional legal services costing INR 2,000 and notarization fees of INR 500. The total fee calculation would be:

Base Fee: INR 20,000

Legal and Advisory Fee: INR 5,000

Documentation & Notarization Fee: INR 500

Total Fee: INR 25,500

This example reflects a typical scenario for Farmer Producer Company Registration, ensuring that applicants have a clear financial outline before initiating the process. Detailed consultation may reveal further nuances dependent on individual business profiles and regional adjustments.

Case Studies and Practical Examples

Real-life examples provide crucial insights into the process and fee calculation for Farmer Producer Company Registration. The following case studies illustrate how different farming entities have navigated the registration process.

Case Study 1: The Green Harvest Cooperative

The Green Harvest Cooperative, operating in Haryana, opted for Farmer Producer Company Registration to streamline its operations and gain better market access. With a focus on sustainable farming practices, the cooperative encountered the following:

- Documentation: Detailed agricultural plans, land documents, and bank statements were required.

- Fee Structure: Owing to its regional base in Haryana, the base registration fee was INR 20,000, with additional advisory charges of INR 5,000.

- Outcome: The complete process was executed within 30 days, establishing a robust framework for future compliance and operational expansion under Farmer Producer Company Registration.

The case of The Green Harvest Cooperative underscores how a thorough understanding of regional nuances and fee obligations helps streamline Farmer Producer Company Registration.

Case Study 2: Rural Agri Ventures

Rural Agri Ventures, based in Uttar Pradesh, is another successful example of a company that benefitted from Farmer Producer Company Registration. The company, focusing on organic produce, undertook the following steps:

- Pre-Registration Consultation: Engaged in expert consultation to assess requirements and forecast additional regulatory costs.

- Fee Calculation: The base registration cost was INR 29,000. Including professional fees (INR 5,000) and extra documentation charges (INR 1,000), the final computed fee reached INR 30,000.

- Benefit: The streamlined registration process facilitated by Farmer Producer Company Registration allowed Rural Agri Ventures to focus on expanding their organic farming network.

These case studies illustrate that with meticulous planning and clear understanding of the fee breakdown, entities across different regions can successfully complete their Farmer Producer Company Registration process.

Case Study 3: AgroFuture Enterprises

AgroFuture Enterprises, located in Maharashtra, opted for Farmer Producer Company Registration as part of its strategic business reorganization. Key takeaways include:

- Regulatory Compliance: Comprehensive submission of all statutory documents as mandated by the latest Companies Act amendments.

- Cost Consideration: The enterprise incurred a base fee of INR 35,000, with additional costs varying by regional governmental impositions.

- Future Prospects: Post-registration, the company reported smoother access to government subsidies and market-linked benefits, reinforcing the merit of the Farmer Producer Company Registration process.

Through these case studies, it is evident that the practical challenges and fee structures for Farmer Producer Company Registration are manageable with proper due diligence and expert support.

Steps to Initiate Your Farmer Producer Company Registration with Vakilkaro

Initiating your Farmer Producer Company Registration process is straightforward when partnered with experienced professionals. Vakilkaro offers expert guidance to help you navigate documentation, fee calculation, and compliance requirements. Follow these steps to get started:

- Contact Vakilkaro for a Consultation:

- Prepare Prerequisite Documents:

- Evaluate Regional Fee Structures:

- Submit Your Application:

- Ongoing Compliance Assistance:

Reach out to Vakilkaro via our official website or hotline to discuss your business objectives and requirements for Farmer Producer Company Registration. A dedicated consultant will assess your specific needs and offer custom advice.

Gather all necessary documents such as identity proofs, land documents, business plans, and financial statements. Ensuring the documentation is complete will simplify the Farmer Producer Company Registration process significantly.

Discuss with Vakilkaro the updated pan-India fee structure, paying particular attention to any regional variations affecting your area. This step is crucial to manage costs and ensures accurate calculation for Farmer Producer Company Registration.

With professional assistance, submit your application through the MCA portal along with the necessary fees. Vakilkaro’s team will guide you through every step to ensure a smooth Farmer Producer Company Registration process.

Post-registration, benefit from Vakilkaro’s comprehensive compliance support, ensuring you meet all regulatory updates under the Companies Act amendments related to Farmer Producer Company Registration.

Taking prompt action in initiating your Farmer Producer Company Registration with Vakilkaro ensures that your cooperative meets all legal and financial requirements, setting a robust foundation for successful future operations.

Conclusion

The journey through Farmer Producer Company Registration is marked by clarity and structured processes, reinforced by the latest amendments in the Companies Act and updated fee structures as set by the government. With detailed guidance on the registration process, fee breakdown, practical examples, and real-life case studies, stakeholders now have access to a comprehensive resource.

Whether you operate in Punjab, Haryana, Maharashtra, Uttar Pradesh, or any other region, the insights provided in this guide on Farmer Producer Company Registration will help you understand the financial commitments and regulatory expectations. It is vital to leverage professional support, such as the expert team at Vakilkaro, to streamline your registration process and ensure ongoing compliance.

Ultimately, with thorough preparation and accurate fee calculations, transitioning to a registered farmer producer company becomes not only a compliance necessity but also an effective strategy for business growth and long-term sustainability. Begin your journey to successful Farmer Producer Company Registration today.

Final Notes

As you embark on your Farmer Producer Company Registration journey, keep the following points in mind:

- Ensure all documentation is complete and accurate as per the latest regulatory mandates.

- Understand the pan-India fee structure and the regional variances that might affect your total cost.

- Seek professional guidance when necessary to ensure smooth and timely processing of Farmer Producer Company Registration.

- Regularly monitor updates on compliance requirements under the Companies Act and government fee revisions.

By following these guidelines and initiating your application through Vakilkaro, you can be confident in achieving a legally compliant and financially sound Farmer Producer Company Registration process.

We hope this guide has provided clarity and actionable insights into the complexities of Farmer Producer Company Registration fees and charges in India. Empower yourself with the right information and take the necessary steps today to set your business on the path to success.

Wrap-Up

In conclusion, every aspect of Farmer Producer Company Registration – from documentation and fee calculation to regulatory compliance – is structured to serve the best interests of farming communities across India. The recent amendments in the Companies Act and the updated government fee structures have streamlined this process, ensuring enhanced transparency and operational excellence.

We encourage you to review each section of this guide carefully and consult with professionals like those at Vakilkaro to facilitate a successful Farmer Producer Company Registration process. The financial transparency and compliance guidelines discussed here are designed to empower your venture and ensure its long-term success in the competitive landscape of agricultural business.

Remember that a well-executed Farmer Producer Company Registration not only meets legal requirements but also creates new opportunities for operational efficiency, improved access to funding, and government subsidies. With this guide as your resource, you are now better equipped to navigate these complexities and drive your business forward.