Section 8 Microfinance Company Registration: Process and Benefits

A Section 8 Microfinance Company is a nonprofit organization dedicated to providing financial services to underserved communities, particularly low-income individuals and small businesses. These companies aim to promote financial inclusion by offering microloans without collateral, enabling entrepreneurship, and supporting economic empowerment. Unlike other financial institutions, a Section 8 Microfinance Company operates with a social welfare motive rather than profit generation.

The registration process involves multiple steps, starting with name reservation and the preparation of essential documents such as the Memorandum of Association (MOA) and Articles of Association (AOA). The application is then submitted to the Registrar of Companies (ROC) under the Companies Act, 2013. Unlike Non-Banking Financial Companies (NBFCs), Section 8 Microfinance Companies do not require prior approval from the Reserve Bank of India (RBI), making the process more accessible and cost-effective.

The registration fee varies depending on government charges, documentation, and professional services involved in the process. Once registered, these companies must comply with regulatory guidelines to maintain transparency and ensure sustainability. By providing small loans at low-interest rates, Section 8 Microfinance Companies play a crucial role in empowering marginalized communities, fostering self-reliance, and supporting rural development. Their impact extends beyond finance, contributing to social and economic progress.

Introduction

Microfinance companies play a crucial role in providing financial assistance to low-income individuals and small businesses that lack access to traditional banking services. These companies facilitate financial inclusion by offering small loans, savings, insurance, and other financial services. In India, a microfinance company can be registered as a Non-Banking Financial Company (NBFC) or under Section 8 of the Companies Act, 2013.

This blog provides an in-depth guide on Microfinance Company Registration, with a special focus on Section 8 Microfinance Company Registration, the registration process, regulatory requirements, and associated fees.

What is a Microfinance Company?

A Microfinance Company is a financial institution that provides micro-loans and financial services to individuals, particularly in rural and economically weaker sections of society. The primary objective of microfinance institutions (MFIs) is to promote financial inclusion by enabling small entrepreneurs, self-help groups, and underprivileged individuals to access credit without requiring collateral.

There are two main ways to register a microfinance company in India:

- Registering as an NBFC-MFI (Non-Banking Financial Company – Microfinance Institution)

- Registering as a Section 8 Microfinance Company

Among these, Section 8 Microfinance Company Registration is the most preferred due to its simplified compliance and lower capital requirements.

What is Section 8 Microfinance Company Registration?

A Section 8 Microfinance Company is registered under Section 8 of the Companies Act, 2013, which allows companies to function as non-profit entities. Unlike NBFC-MFIs, which require a minimum net-owned fund of ₹5 crores, Section 8 Microfinance Companies can be started with minimal capital.

Benefits of Section 8 Microfinance Company Registration

- No Minimum Capital Requirement: Unlike NBFCs, Section 8 companies do not require high capital investment.

- No RBI Approval Required: Section 8 microfinance companies do not require RBI registration.

- Tax Exemptions: Section 8 companies enjoy tax benefits under the Income Tax Act.

- Limited Liability: The liability of members is limited, protecting their personal assets.

- Government Recognition: These companies receive legal backing for their operations.

- Social Impact: They focus on financial inclusion and rural development.

Microfinance Company Registration Process

Step 1: Choose the Type of Microfinance Company

Decide whether you want to register as an NBFC-MFI or a Section 8 Microfinance Company. For small-scale financial lending without RBI regulations, Section 8 is preferable.

Step 2: Obtain DSC and DIN

Directors must obtain a Digital Signature Certificate(DSC) and Director Identification Number (DIN) from the Ministry of Corporate Affairs (MCA).

Step 3: Name Approval

Apply for name approval through the RUN (Reserve Unique Name) service on the MCA portal. The name should include words such as “Foundation,” “Society,” or “Association.”

Step 4: Draft the Memorandum of Association (MoA) and Articles of Association (AoA)

Prepare the MoA and AoA, defining the objectives and operational structure of the company.

Step 5: Apply for Section 8 License

Submit an application to the Registrar of Companies (ROC) along with necessary documents, including financial statements and business objectives.

Step 6: Company Incorporation

Once the license is approved, file the incorporation application (SPICe+ form) along with the necessary documents.

Step 7: Obtain PAN, TAN, and Bank Account

After incorporation, apply for PAN (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number), and open a bank account in the company’s name.

Microfinance Company Registration Fee

The fee structure for Section 8 Microfinance Company Registration varies based on professional charges, government fees, and documentation costs. Here is an estimated breakdown:

- Digital Signature Certificate (DSC): ₹1,500 – ₹2,000 per director

- Director Identification Number (DIN): ₹500 per director

- Name Approval Fee: ₹1,000

- Section 8 License Fee: ₹5,000 – ₹10,000

- Incorporation Fee: ₹3,000 – ₹5,000

- Legal and Professional Fees: ₹10,000 – ₹30,000 (varies based on service provider)

- PAN and TAN Application: ₹200 – ₹300

Total estimated cost: ₹25,000 – ₹50,000 (excluding operational costs).

Documents Required for Microfinance Company Registration

- Directors’ Documents:

PAN Card

Aadhaar Card

Passport-sized photographs

Address proof (electricity bill, bank statement, etc.)

- Company Documents:

MoA and AoA

Business plan

Registered office address proof

No Objection Certificate (NOC) from the property owner

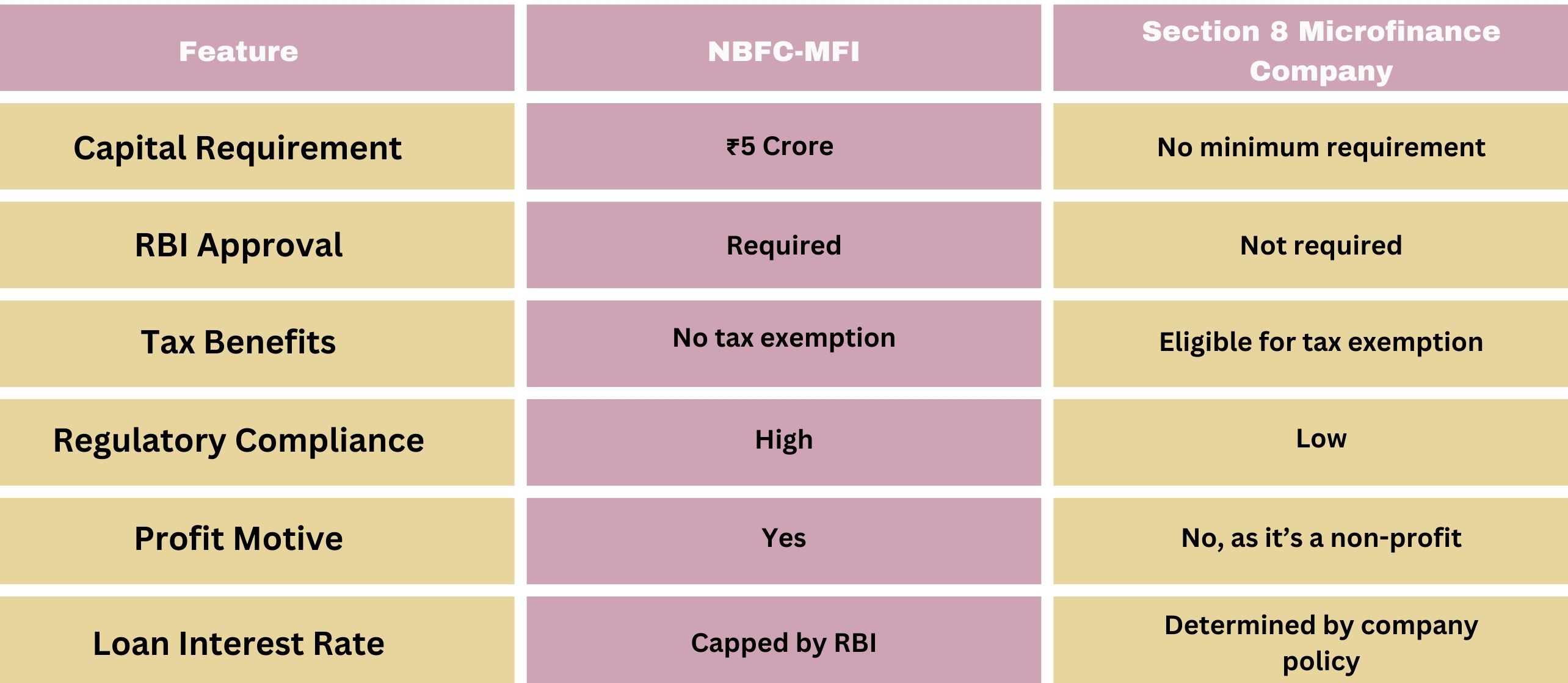

Difference Between NBFC-MFI and Section 8 Microfinance Company

Compliance Requirements for Section 8 Microfinance Companies

- Annual Filing with ROC: File AOC-4 (Financial Statements) and MGT-7 (Annual Return).

- Income Tax Filing: File annual income tax returns to claim exemptions.

- GST Compliance: If applicable, file GST returns

- CSR Activities: Engage in community development projects as per company objectives.

How to Get Loan Funding for a Section 8 Microfinance Company?

- Government Schemes: Apply for funding from government microfinance schemes.

- NGO Grants: Seek financial assistance from NGOs supporting microfinance initiatives.

- Bank Loans: Obtain loans from public and private sector banks.

- Crowdfunding: Raise funds from social investors and crowdfunding platforms.

- Corporate Social Responsibility (CSR) Funds: Collaborate with companies for CSR funding.

Conclusion

Registering a Microfinance Company is a significant step towards promoting financial inclusion. While NBFC-MFI registration requires strict compliance and high capital investment, Section 8 Microfinance Company Registration is an ideal alternative for those seeking to operate a non-profit microfinance institution.

By following the correct registration process, ensuring compliance, and leveraging available funding options, a Section 8 Microfinance Company can play a pivotal role in uplifting economically weaker sections and fostering inclusive economic growth in India.

If you’re looking for professional assistance in Microfinance Company Registration or need clarity on the Microfinance Company Registration Fee, consult legal and financial experts to ensure a hassle-free registration process.

Why Choose Vakilkaro for Microfinance Company Registration?

Vakilkaro is a trusted legal and financial service provider specializing in company registration, compliance, and regulatory approvals. When it comes to Microfinance Company Registration, including Section 8 Microfinance Company Registration, Vakilkaro stands out due to its expertise, efficiency, and client-centric approach.

1. Expert Guidance from Professionals

Vakilkaro has a team of experienced professionals, including legal experts, chartered accountants, and company secretaries, who provide end-to-end assistance. From choosing the right type of microfinance company to preparing the necessary documentation, Vakilkaro ensures a smooth registration process.

2. Hassle-Free Compliance Support

Navigating legal and regulatory requirements can be complex. Vakilkaro simplifies the process by handling compliance matters such as ROC filings, drafting MOA & AOA, obtaining licenses, and ensuring adherence to RBI and government guidelines.

3. Cost-Effective and Transparent Services

Vakilkaro offers affordable pricing for microfinance company registration, ensuring transparency in fees without hidden charges. Their structured process helps clients save both time and money.

4. Personalized Assistance and Timely Updates

Vakilkaro provides dedicated support throughout the registration process, offering regular updates and assistance in responding to any queries from regulatory authorities.

5. Post-Registration Support

Beyond registration, Vakilkaro helps with compliance, annual filings, financial management, and RBI guidelines to ensure seamless operations.

Choosing Vakilkaro for Microfinance Company Registration means opting for a reliable, professional, and hassle-free experience to kickstart your financial inclusion journey.

Why Choose VakilKaro for Other Related Services?

VakilKaro is a one-stop solution for various legal, financial, and business registration services. With a strong reputation for professionalism, efficiency, and transparency, VakilKaro assists individuals and businesses in meeting their legal and compliance needs seamlessly.

1. Expertise Across Multiple Domains

VakilKaro specializes in a wide range of services, including company registration (Private Limited, LLP, OPC, Section 8), GST compliance, trademark registration, legal documentation, tax advisory, and RBI licensing. Their team of experienced professionals ensures that clients receive accurate guidance tailored to their specific business requirements.

2. End-to-End Support and Compliance Management

Whether it’s company formation, trademark filing, tax compliance, or financial advisory, VakilKaro provides end-to-end support. Their expertise in navigating government regulations and legal frameworks ensures smooth approvals and adherence to necessary guidelines.

3. Affordable and Transparent Pricing

VakilKaro offers cost-effective solutions with transparent pricing, ensuring that clients get value-for-money services without hidden charges. Their streamlined processes help save time and reduce unnecessary expenses.

4. Personalized Assistance and Timely Updates

VakilKaro assigns dedicated professionals to handle client queries, ensuring regular updates and hassle-free communication throughout the process. Their proactive approach helps businesses stay compliant and avoid legal complications.

5. Post-Service Assistance and Ongoing Compliance

Beyond registration and legal formalities, VakilKaro assists businesses with annual filings, licensing renewals, and compliance with government regulations to ensure long-term operational success.

Choosing VakilKaro means partnering with a reliable and professional service provider that simplifies legal complexities and helps businesses grow with confidence.