NBFC License Cost in India: A Complete Overview

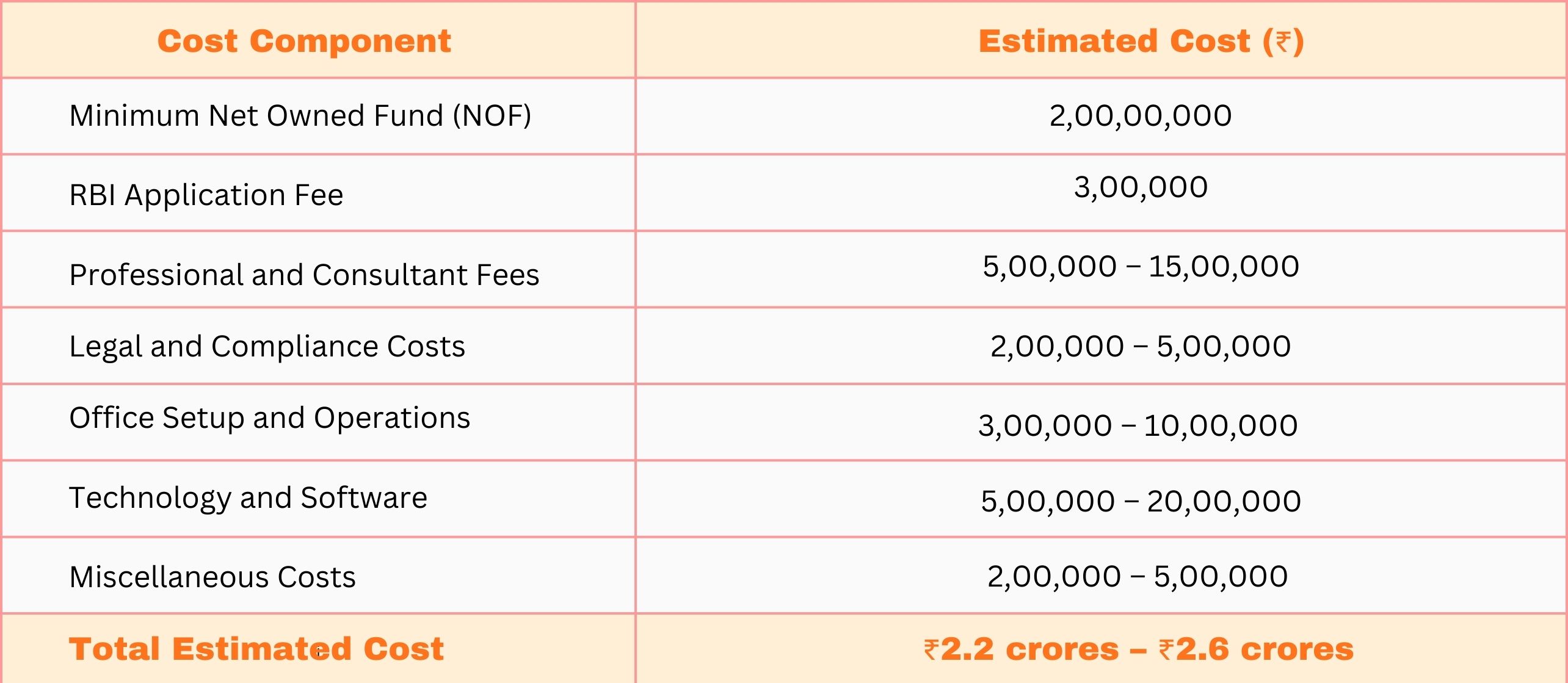

Starting a Non-Banking Financial Company (NBFC) in India involves several costs and compliance requirements. The primary expense is meeting the minimum Net Owned Fund (NOF) of ₹2 crores, mandated by the Reserve Bank of India (RBI). Additionally, a non-refundable application fee of ₹3 lakhs is required for submitting the license application. Since the registration process is complex, many entrepreneurs hire professional consultants for assistance, with fees ranging from ₹5 to ₹15 lakhs.

Legal and compliance expenses for drafting key documents and fulfilling regulatory requirements can add another ₹2 to ₹5 lakhs. Establishing a registered office is mandatory and may cost ₹3 to ₹10 lakhs, depending on the city and scale of operations. Investment in technology is crucial, especially for NBFCs dealing with lending, to ensure seamless operations and regulatory compliance. Custom software for loan management, customer relationship management (CRM), and compliance monitoring can cost anywhere between ₹5 to ₹20 lakhs.

Additional costs include employee recruitment, training, marketing, branding, and ongoing compliance requirements such as quarterly filings and statutory audits. These miscellaneous expenses can range from ₹2 to ₹5 lakhs. Overall, the total cost for obtaining an NBFC license typically falls between ₹2.2 crores and ₹2.6 crores, varying based on the business model, technology adoption, and operational scale. Factors like the type of NBFC—such as microfinance, asset finance, or peer-to-peer lending—also affect the cost structure.

Reducing costs is possible through careful planning, starting with a focused business model, and investing in scalable technology. Proper compliance management helps avoid penalties and additional legal expenses. By understanding the cost components and planning effectively, entrepreneurs can build a sustainable NBFC that meets regulatory standards and achieves long-term success.

Introduction

In recent years, Non-Banking Financial Company (NBFCs) have emerged as a vital part of the Indian financial sector. These institutions play a crucial role in credit delivery, financial inclusion, and economic growth. If you’re planning to start an NBFC in India, understanding the process and cost of obtaining an NBFC license is essential. This guide will cover everything you need to know about the costs involved, regulatory requirements, and tips for managing expenses.

In recent years, Non-Banking Financial Companies (NBFCs) have become integral to India’s financial landscape, contributing significantly to credit delivery, financial inclusion, and economic growth. As key players in providing loans and financial services, NBFCs are essential in reaching underserved populations and boosting sectors like microfinance, housing finance, and asset financing.

If you’re considering starting an NBFC in India, it’s important to understand the process and costs associated with obtaining an NBFC license. This guide will walk you through the regulatory requirements, investment considerations, and strategies for managing costs, ensuring a smooth setup and compliance with legal standards. With a clear understanding of the expenses and regulations, you can position your NBFC for long-term success.

What is an NBFC?

NBFCs are financial institutions that offer various banking services, except for traditional banking operations such as accepting demand deposits. NBFCs can engage in several activities, including loans and advances, asset financing, hire purchase, insurance, and investments in marketable securities.

Types of NBFCs in India

NBFCs are broadly categorized based on their activities and the type of liabilities they carry. Some of the common categories include:

- Investment and Credit Companies (NBFC-ICC)

- Microfinance Institutions (NBFC-MFI)

- Asset Finance Companies (NBFC-AFC)

- Housing Finance Companies (HFC)

- Infrastructure Finance Companies (NBFC-IFC)

- Peer-to-Peer Lending Platforms (NBFC-P2P)

- NBFC-Factor (factoring business)

Each category has specific regulatory and capital requirements set by the Reserve Bank of India (RBI). The cost of obtaining an NBFC license depends on the type of NBFC and its business plan.

Breakdown of NBFC License Cost in India

1. Minimum Net Owned Fund (NOF) Requirement

The primary cost component for starting an NBFC is the capital requirement. According to RBI guidelines, an NBFC must have a minimum Net Owned Fund (NOF) of ₹2 crores.

For certain specialized NBFCs like NBFC-MFIs or NBFC-Factors, the minimum capital requirement may differ.

What is Net Owned Fund (NOF)?

NOF is the net worth of the company, calculated as the sum of paid-up equity capital and reserves, minus any accumulated losses. This capital must be maintained as a buffer for business operations and compliance with regulatory standards.

Cost Calculation for NOF

Here’s a sample cost breakdown for achieving the ₹2 crore NOF requirement:

- Paid-up Capital: ₹1.50 crores

- Reserves and Surplus: ₹0.50 crores

- Deductions for Losses or Intangible Assets: Nil

The company must show this amount in its audited financial statements while applying for the NBFC license.

2. RBI Application Fee

To apply for an NBFC license, you must submit the prescribed application form (available on the RBI’s COSMOS portal) along with a non-refundable application fee.

- RBI Application Fee: ₹3,00,000

This fee covers the cost of processing your application. Ensure that all documents are in order to avoid rejection or delays.

3. Professional Fees and Consultant Charges

Obtaining an NBFC license is a complex process that involves legal, financial, and compliance-related tasks. Most applicants hire professional consultants to assist with:

- Business plan preparation

- Compliance documentation

- RBI interactions

- Financial audits

Professional Fees can range from ₹5 lakhs to ₹15 lakhs, depending on the consultant’s expertise and scope of work. It’s advisable to choose a reliable consultancy with a proven track record in NBFC registration.

4. Legal and Compliance Costs

NBFCs are highly regulated by the RBI and must adhere to strict compliance standards. Legal expenses include drafting Memorandums of Association (MoA), Articles of Association (AoA), and other statutory documents.

Estimated Legal Fees: ₹2 lakhs to ₹5 lakhs

Compliance costs will also include obtaining necessary approvals, registrations (like PAN, TAN, GST, etc.), and meeting ongoing compliance requirements such as quarterly filings, KYC norms, and audits.

5. Office Setup and Operational Costs

Having a physical office space is mandatory for NBFCs. The RBI may conduct physical verification of your registered office before granting the license.

Office Setup Costs: ₹3 lakhs to ₹10 lakhs (depending on location and size)

Additionally, operational expenses like salaries, utilities, IT infrastructure, and software solutions (especially for NBFCs involved in lending) should be considered.

6. Technology and Software Costs

Modern NBFCs rely heavily on technology to manage operations, customer interactions, and compliance. Depending on the type of NBFC, you may need custom-built software solutions for:

- Loan management

- CRM (Customer Relationship Management)

- Compliance monitoring and reporting

Estimated Software Costs: ₹5 lakhs to ₹20 lakhs

NBFCs in the lending business often invest in advanced fintech solutions for seamless customer service and compliance with RBI’s digital requirements.

7. Other Miscellaneous Costs

Several additional expenses can arise during the registration and operational setup:

- Statutory Audits and Accounting Fees

- Employee Recruitment and Training

- Marketing and Branding

Estimated Miscellaneous Costs: ₹2 lakhs to ₹5 lakhs

These costs may vary based on the scale and complexity of the business.

Total Cost Estimate for NBFC License

Based on the components mentioned above, here’s an approximate cost estimate:

Factors Affecting NBFC License Cost

Several factors can influence the cost of obtaining an NBFC license:

- Type of NBFC – Microfinance, asset finance, and P2P lending platforms have different capital and compliance requirements.

- Location – Setting up in metro cities may result in higher office rent and operational expenses.

- Business Model – The complexity of the business model affects technology and consultant fees.

- Regulatory Changes – Frequent changes in RBI guidelines can increase compliance and audit costs.

How to Reduce NBFC License Costs

Here are some tips to optimize expenses during the NBFC registration process:

- Hire an Experienced Consultant: They can help you avoid costly mistakes and delays.

- Leverage Technology: Invest in scalable and affordable tech solutions for compliance and operations.

- Start Small: Begin with a focused business model and expand later. This can reduce initial capital and operational costs.

- Build a Strong Compliance Framework: A robust compliance setup will reduce the risk of penalties and additional legal costs.

Ongoing Compliance Costs for NBFCs

Once the license is obtained, NBFCs must meet regular compliance requirements. These include:

- Filing quarterly and annual returns

- Statutory audits

- KYC and anti-money laundering compliance

- Reserve fund maintenance

Estimated Annual Compliance Cost: ₹5 lakhs to ₹15 lakhs

Conclusion

Obtaining an NBFC license in India is a significant investment, but it can be a rewarding business opportunity if planned and executed well. By understanding the costs involved and managing them effectively, you can build a sustainable and compliant NBFC. Whether you’re planning to set up a microfinance company, an asset finance business, or a fintech-driven NBFC, having a clear cost structure and strategy is key to success.

Obtaining an NBFC license in India is a substantial investment, requiring careful planning and execution. The process involves various costs, including minimum capital requirements, legal and regulatory fees, and operational expenses. While these costs may seem significant, a well-planned strategy can lead to long-term success.

Managing these expenses effectively and understanding the financial landscape is crucial for building a sustainable and compliant NBFC. Whether you’re establishing a microfinance company, an asset finance business, or a fintech-driven NBFC, having a clear cost structure, business model, and compliance strategy will be pivotal in navigating the regulatory complexities and achieving profitability. By aligning your financial and operational goals, you can capitalize on the growing demand for financial services in India.

Why Choose VakilKaro for NBFC License Registration and Cost Management?

Choosing VakilKaro for your NBFC license registration ensures a smooth, efficient, and cost-effective process. Here’s why:

- Expert Guidance: VakilKaro’s experienced professionals understand the intricacies of NBFC registration, from fulfilling RBI requirements to drafting necessary legal documents. Their expertise ensures you avoid costly mistakes, saving you time and money.

- End-to-End Support: VakilKaro offers comprehensive support, covering everything from the application process and consultant fees to ongoing compliance needs. With their assistance, you’ll have a clear roadmap for obtaining your license and managing operational expenses.

- Tailored Solutions: VakilKaro tailors its services to your business model, helping you choose the right type of NBFC and assisting with the required capital, documentation reducing unnecessary costs and ultimately NBFC registration.

- Transparent Pricing: With VakilKaro, you get a clear breakdown of all costs involved, including professional fees, legal expenses, and office setup. They help you understand each component, allowing you to plan your budget effectively.

- Cost Optimization: VakilKaro’s expert consultants can recommend ways to optimize costs while ensuring compliance with regulatory standards. Their proactive approach helps minimize unnecessary expenditure without compromising quality.

- Ongoing Compliance Management: After obtaining your NBFC license, VakilKaro continues to offer services for meeting ongoing compliance requirements, including filings, audits, and KYC regulations, at competitive rates.

By choosing VakilKaro, you’re not just securing an NBFC license, but also partnering with a team that helps you navigate the financial and regulatory landscape with confidence. Their comprehensive and customer-focused services make them a trusted choice for aspiring NBFC entrepreneurs.

Why Choose VakilKaro for a Wide Range of Legal and Business Services?

VakilKaro offers a broad spectrum of services that go beyond just NBFC licensing, catering to all your business and legal needs. Here’s why you should choose VakilKaro for these essential services:

- Expert Legal Counsel Across Sectors: Whether it’s company registration, trademark protection, drafting contracts, or dispute resolution, VakilKaro’s legal team provides specialized expertise tailored to your business needs. Their experience ensures that your legal requirements are addressed efficiently, minimizing risks and protecting your interests.

- End-to-End Solutions for Business Registration: VakilKaro simplifies complex business registration processes, including Private Limited Company Registration (PLC), Limited Liability Partnership Registration (LLP), and even microfinance company setups. Their step-by-step guidance ensures smooth and timely completion, allowing you to focus on growing your business.

- GST Compliance & Tax Advisory: VakilKaro offers expert tax advisory and GST return filing that help your business stay compliant with the latest tax regulations. With their support, you can minimize tax liabilities while optimizing your financial structure for growth.

- Intellectual Property Protection: From trademark registration to patent protection, VakilKaro assists you in safeguarding your intellectual property. This helps your brand and innovations stay protected in a competitive market, adding long-term value to your business.

- RBI Licenses & Microfinance Support: VakilKaro specializes in assisting businesses with obtaining RBI licenses for microfinance institutions and other NBFCs. Their deep understanding of financial regulations ensures a seamless process from start to finish.

- Customized Business Solutions: VakilKaro understands that every business is unique, which is why they offer personalized services that align with your business goals. Whether you need help with compliance, structuring, or legal documentation, their solutions are tailored to meet your specific needs.

- Affordable & Transparent Pricing: VakilKaro is committed to offering high-quality services at affordable rates, ensuring that businesses of all sizes have access to expert guidance without exceeding their budgets. Their pricing model is transparent, so there are no hidden charges or surprises.

- Comprehensive Support Across All Phases: Whether you’re starting a new venture or looking to expand, VakilKaro supports you throughout your business journey. Their services span across various stages, from business registration and tax filings to intellectual property protection and legal advisory.

Choosing VakilKaro means partnering with a trusted advisor who is committed to your business’s growth, ensuring that you meet all legal, regulatory, and operational requirements. With their all-encompassing services, you can navigate the complexities of business with ease and confidence.