The Importance of Digital Signature Certificates (DSC) for NGO Registration in India

When it comes to establishing an NGO in India, a frequently asked question is whether a Digital Signature Certificate (DSC) is required for the registration process. The answer is generally yes, especially for certain types of NGO registration like Section 8 companies and applications for 12A and 80G certifications. These digital signatures are essential for ensuring compliance and simplifying the registration process with the government.

A DSC is an electronic form of a signature that authenticates digital documents, providing a secure and legally recognized method of signing online forms. It is issued by Certifying Authorities (CAs) and is recognized under the Information Technology Act, 2000. While DSCs are not required for all types of NGO registrations, they are mandatory for specific procedures like Section 8 company registration. Section 8 companies, which are formed with the aim of promoting charitable objectives, require digitally signed documents for submission to the Ministry of Corporate Affairs (MCA). Documents like the incorporation form (INC-32), the Memorandum of Association (MOA), and Articles of Association (AOA) must all be signed electronically by the proposed directors and professionals assisting in the registration process.

For Trusts and Societies, DSCs may not be necessary at the initial registration stage with state authorities, but they become crucial when applying for tax exemptions under Section 12A and for donor benefits under Section 80G. Both of these processes require electronically signed forms and supporting documents to be uploaded on the Income Tax portal, making a valid DSC indispensable.

Overall, DSCs play a vital role not only in initial registration but also in ongoing operations, including filing annual returns, income tax submissions, and applying for government grants. Therefore, ensuring that your NGO has a DSC is a step towards smooth and compliant operations in the long term.

Introduction

Setting up a Non-Governmental Organization (NGO) in India is an exciting and fulfilling endeavor, but it also comes with a series of legal and regulatory requirements. One of the most frequently asked questions by aspiring founders is whether a Digital Signature Certificate (DSC) is necessary for the registration process. The short answer is yes—whether you are establishing a Trust, Society, or Section 8 Company, a DSC is either mandatory or highly recommended for the registration process, depending on the type of NGO.

A Digital Signature Certificate is an electronic form of a signature that is legally recognized under the Information Technology Act, 2000. It is used to authenticate digital documents, ensuring that they are signed and verified with the same legal weight as a handwritten signature on paper documents. In the context of NGO registration, a DSC simplifies and secures the filing of online documents required by government portals, such as the Ministry of Corporate Affairs (MCA) or the Income Tax Department.

This blog will delve deeper into the significance of DSCs and their role in various stages of NGO registration. We will explore the different types of NGO structures, such as Trusts, Societies, and Section 8 companies, and highlight how DSCs are integrated into these processes. Additionally, we’ll discuss how DSCs are essential when applying for 12A and 80G registration, which provides tax exemptions and donor benefits for NGOs. By understanding the importance of DSCs, you can ensure that your registration process runs smoothly and complies with all necessary legal formalities.

Whether you are a social entrepreneur looking to formalize your charitable initiative or someone exploring how to structure and register an NGO, this guide will help you understand how Digital Signature Certificates fit into the larger picture of NGO registrationin India.

Understanding the Basics: What is a Digital Signature Certificate (DSC)?

A Digital Signature Certificate (DSC) is an electronic form of a signature that can be used to authenticate documents online. It is issued by Certifying Authorities (CAs) in India and is legally recognized under the Information Technology Act, 2000. Just like a handwritten signature authenticates a physical document, a DSC authenticates electronic documents.

Why DSC Matters for NGO Registration?

When registering an NGO, especially as a Section 8 company, you are required to submit several documents to government portals like the Ministry of Corporate Affairs (MCA). These portals only accept electronically signed documents—this is where a DSC becomes mandatory.

Additionally, for procedures like applying for 12A and 80G registration with the Income Tax Department, digitally signed documents speed up the process and ensure legal compliance.

Types of NGO Registration in India

Before we delve deeper into DSC requirements, let’s understand the various forms of NGO registration in India:

- Trust under the Indian Trusts Act, 1882

- Society under the Societies Registration Act, 1860

- Section 8 Company under the Companies Act, 2013

Among these, Section 8 company registration is the most structured form and requires more formalities—including the use of DSCs—during the registration process.

Digital Signatures and Section 8 Company Registration

Let’s first discuss Section 8 company registration, which is governed by the Companies Act, 2013 and regulated by the Ministry of Corporate Affairs (MCA).

DSC Requirement in Section 8 Company Registration:

During the registration process, several documents are filed electronically, including:

- INC-32 (SPICe+) – Application for Incorporation

- INC-33 – Memorandum of Association (MOA)

- INC-34 – Articles of Association (AOA)

All these forms need to be digitally signed by:

- The proposed directors (at least two for a private limited company)

- A practicing professional such as a Chartered Accountant, Company Secretary, or Cost Accountant

Hence, each director must obtain a Class 3 Digital Signature Certificate before filing these forms.

Key Points:

- At least two DSCs are mandatory for a Section 8 company.

- The DSC must be registered with the MCA portal.

- A professional must also have a valid DSC to assist in filings.

So, if you’re pursuing Section 8 company registration, yes—you absolutely need DSCs.

DSC and Trust/Society Registration

When registering an NGO as a Trust or Society, DSCs may not be required during the initial registration at the state level. These registrations are typically paper-based and handled by state authorities or the local Registrar of Trusts or Societies.

However, once your Trust or Society seeks income tax exemptions through 12A and 80G registration, the role of DSC becomes important again.

12A and 80G Registration: Where DSC Comes In?

After successfully registering your NGO—whether as a Trust, Society, or Section 8 Company—you’ll likely want to apply for 12A and 80G registration. Here’s what they mean:

- 12A Registration: Provides income tax exemption to the NGO.

- 80G Registration: Allows donors to claim tax deductions on donations made to your NGO.

These applications are made online through the Income Tax portal and require the uploading of multiple documents such as registration certificates, financial statements, and governing documents.

DSC Requirements for 12A and 80G:

- The application is submitted online using Form 10A or Form 10AB (depending on the status of the NGO).

- The authorized signatory must digitally sign the form using a valid DSC.

- The DSC must be linked with the PAN of the NGO and its authorized representative.

This means that even if your NGO is a Trust or Society, a DSC is necessary for obtaining 12A and 80G status.

Benefits of Using DSC in NGO Operations

Beyond just registration, having a DSC can be beneficial for ongoing NGO operations:

- Annual filings (especially for Section 8 companies via MCA)

- Income tax returns filing

- Foreign contribution (FCRA)compliance, if applicable

- Applying for government grants or CSR funding

- E-tendering or online bidding for NGO-related projects

With everything moving online, digital authentication is not just a requirement—it’s an operational necessity.

How to Obtain a Digital Signature Certificate (DSC)?

Getting a DSC is a straightforward process:

Step 1: Choose the Right Certifying Authority (CA)

Some popular licensed Certifying Authorities in India include:

- eMudhra

- Sify

- NSDL

- Capricorn

Step 2: Select the Type and Class

- Class 3 DSC is generally required for NGO and company registrations.

- Choose a Sign + Encrypt variant for added utility.

Step 3: Submit Documents

- PAN Card

- Aadhaar Card

- Passport-sized photo

- Address proof

- Email ID and mobile number

Step 4: Verification and Approval

You will go through video verification or in-person verification, depending on the CA.

Once approved, the DSC will be issued and can be stored on a USB token for secure usage.

Common Questions Around DSC for NGOs

1. Can I register an NGO without DSC?

If you’re registering as a Trust or Society, you can initially do so without a DSC. However, for Section 8 company registration and applying for 12A and 80G, a DSC is mandatory.

2. Is one DSC enough for NGO registration?

Not necessarily. For a Section 8 company, each director needs their own DSC. Plus, a professional assisting with incorporation must also have one.

3. Is DSC required every year?

For filings like annual returns (e.g., Form AOC-4, MGT-7 for Section 8 companies), income tax filings, or renewal of 12A/80G (in some cases), a DSC is needed every time you log in and submit forms online.

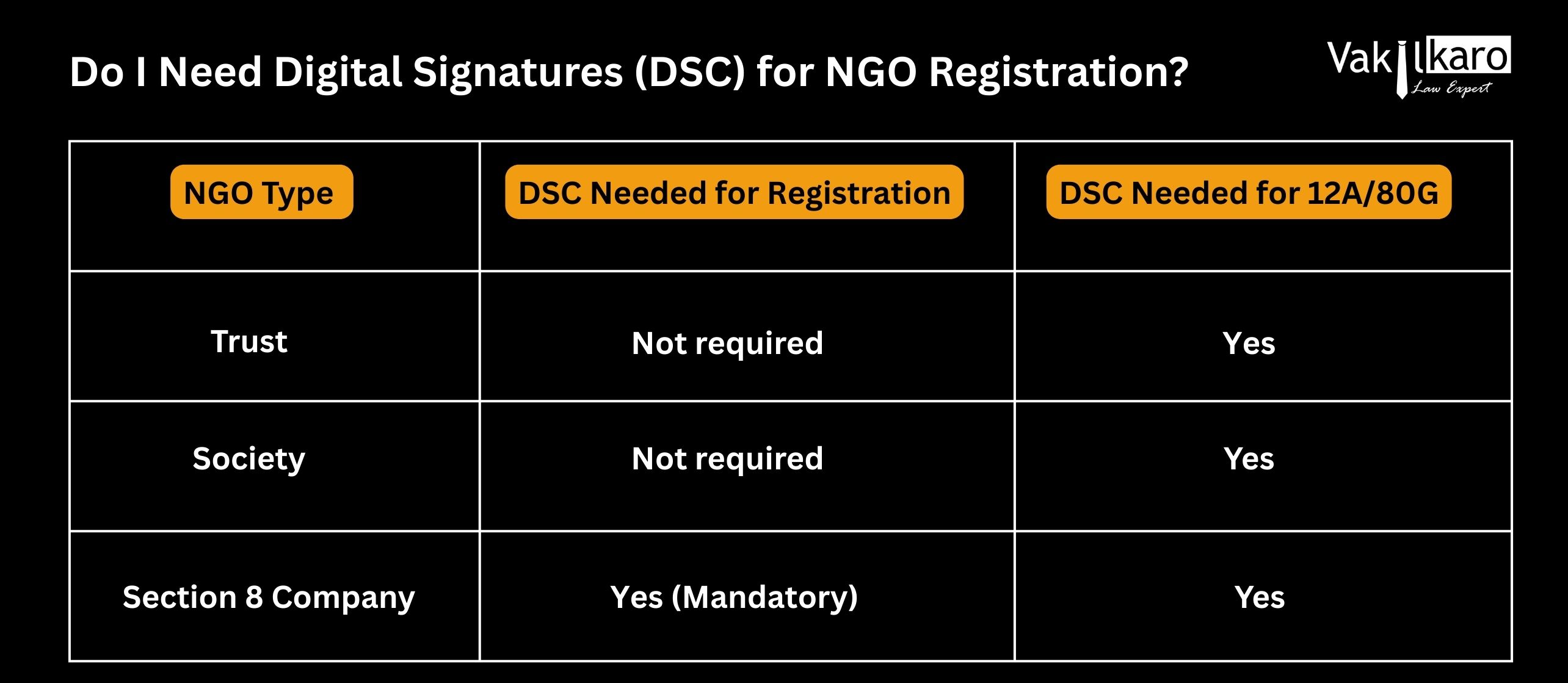

Summary Table: DSC Requirement Based on NGO Type

Final Thoughts

So, do you need a DSC for NGO registration? It depends on the form of your NGO:

- If you are going for Section 8 company registration, DSC is non-negotiable.

- For Trust or Society registration, you might not need it at the registration stage but will definitely need it later when applying for 12A and 80G registration.

- Regardless of the NGO structure, having a DSC is highly recommended as it streamlines digital compliance, reduces paperwork, and helps you stay future-ready.

Whether you’re forming an NGO to promote education, health, women empowerment, environmental causes, or any other social good, ensuring your documentation is DSC-compliant will save you from legal and operational hassles.

If you’re just starting out, consider consulting a professional or NGO registration service provider to guide you through obtaining a DSC and completing the process for Section 8 company registration, NGO registration, and 12A and 80G registration in a compliant manner.

Why Choose Vakilkaro for NGO Registration and Legal Services?

When it comes to registering an NGO or navigating the complexities of legal and compliance procedures in India, choosing the right partner is crucial for success. Vakilkaro stands out as a trusted and efficient service provider for all legal needs, including NGO registration, DSC procurement, and obtaining 12A and 80G certifications. Here’s why you should choose Vakilkaro for your NGO’s legal services:

- Expert Legal Assistance: Vakilkaro is home to experienced legal professionals who understand the intricate requirements of NGO registration, including the need for a Digital Signature Certificate (DSC). Whether you are registering a Trust, Society, or Section 8 Company, we guide you step by step through the entire process, ensuring compliance with all legal regulations.

- Comprehensive Services: Apart from NGO registration, Vakilkaro offers a range of legal services including DSC procurement, trademark registration, tax filings, and assistance with 12A and 80G applications. This one-stop solution saves you time and ensures that all legal aspects are covered seamlessly.

- Affordable and Transparent Pricing: We offer affordable pricing for our services without compromising on quality. Vakilkaro ensures transparency, so you know exactly what you’re paying for, with no hidden fees or surprise charges.

- Personalized Guidance: Every NGO is unique, and at Vakilkaro, we take the time to understand your goals and needs. Our team provides tailored solutions, helping you choose the right structure and guiding you through the specific legal requirements of your NGO.

- Efficient and Timely Service: We understand that time is of the essence when it comes to setting up an NGO. Vakilkaro prioritizes speed and efficiency, ensuring that your NGO registration process is completed in the shortest time possible, with all necessary legal paperwork done correctly.

- Trusted by Thousands: Vakilkaro has successfully assisted hundreds of clients in setting up their NGOs and other legal entities, building a reputation for reliability and excellence. Our customer-first approach has earned us the trust of individuals and organizations across the country.

By choosing Vakilkaro, you’re choosing a partner who is committed to ensuring that your NGO is legally compliant and ready to make a positive impact in society.